Bitcoin is attempting to rally after weeks of consolidation and sustained selling pressure that followed the sharp drop on October 10. The market remains in a delicate recovery phase, with volatility compressing as traders wait for the next big catalyst. This week could prove decisive as all eyes turn to Wednesday’s Federal Reserve meeting, where policymakers are expected to announce their next interest rate action, a decision that could shape global risk sentiment for the rest of the year.

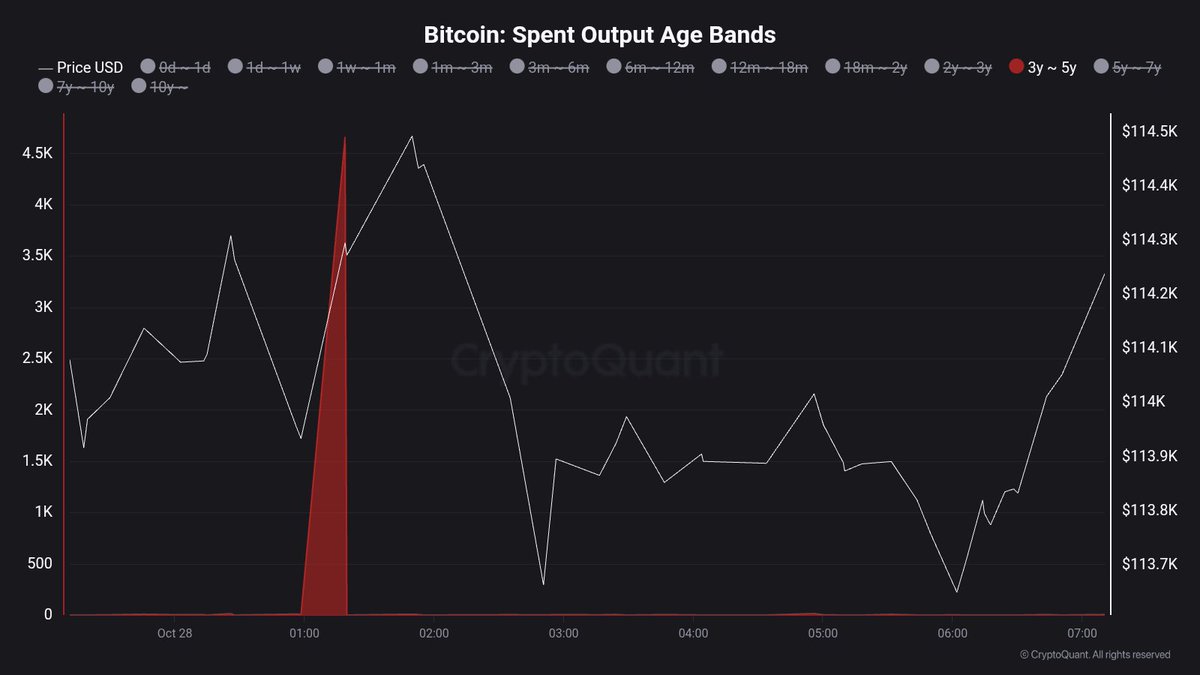

On-chain data adds another layer of intrigue to the current setup. According to CryptoQuant, Bitcoin’s dormant supply is waking up, with long-dormant coins (between three and five years) showing significant movement in recent blocks. This activity often indicates renewed commitment by long-term holders, sometimes preceding key market turning points.

While the near-term outlook remains mixed, analysts note that the revival of ancient currencies amid tightening macroeconomic conditions suggests growing investor anticipation. If the Federal Reserve signals a softer stance on monetary policy, Bitcoin could see renewed capital inflows. However, another aggressive surprise could extend the consolidation phase, keeping BTC locked below resistance until clearer macroeconomic conditions emerge.

Long-term holders take a step

Prominent analyst Maartunn shared data revealing that the 3-5 year dormant supply of Bitcoin has seen a sudden surge in activity, with 4,657.48 BTC spent in a single recent block. This metric tracks coins that have been untouched for several years, a cohort often associated with early bull cycle investors or long-term strategic holders. When these currencies move, it typically indicates renewed activity from investors who have made it through multiple phases of the market.

In the historical context, similar long-term supply awakenings have preceded major changes in market structure. For example, during past consolidation periods, old currencies rallied as investors prepared for volatility, either to take profits near local highs or to reposition ahead of a trend reversal. The magnitude of this recent move suggests that experienced holders are once again reevaluating their allocations amid tightening macroeconomic conditions and elevated expectations for the Federal Reserve’s interest rate decision this week.

What makes this particularly interesting is the contrast to current sentiment. Despite the increase in activity from long-term holders, on-chain indicators such as the Bullish-Bearish Structure Index and the Unified Sentiment Index remain in slightly bullish territory. This implies that while some early investors are taking profits or reallocating, the broader market conviction is improving, especially as Bitcoin remains above the $113,000 to $114,000 range.

This move should not be interpreted as panic selling, but as a healthy rotation in the chain. Long-term holders moving coins after years of inactivity often signal the beginning of liquidity redistributions that accompany the next phase of market growth. If Bitcoin maintains its current support levels and macroeconomic conditions remain stable, these changes could fuel the liquidity needed for a new phase of momentum towards higher prices.

BTC bulls regain momentum

Bitcoin is showing renewed strength in the 3-day period, currently trading near $114,485, as it attempts to recover from the sharp sell-off seen in early October. The chart shows that BTC remains firmly above the 50-day (blue) and 100-day (green) moving averages, a key structural signal that suggests the medium-term trend remains intact despite the recent volatility.

The next major resistance level lies at $117,500, an area that has repeatedly capped Bitcoin’s gains over the past two months. A successful breakout and daily close above this level could open the door to a retest of $125,000, marking the possible start of new bullish momentum. However, rejection here could signal another near-term consolidation, as traders take profits and reassess risk amid macroeconomic uncertainty.

On the downside, immediate support lies between $111,000 and $112,000, while the 200-day moving average (red), around $96,000, continues to provide long-term structural support.

Momentum indicators and on-chain data, including a rebound in sentiment and stable liquidity conditions, suggest buying interest is gradually returning. If the broader market remains calm following the upcoming Federal Reserve rate decision, Bitcoin could confirm its recovery and head further towards the $120,000 to $125,000 range.

Featured image from ChatGPT, chart from TradingView.com

Editorial process for bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We maintain strict sourcing standards and every page undergoes diligent review by our team of technology experts and experienced editors. This process ensures the integrity, relevance and value of our content to our readers.