Tokyo-based Metaplanet, also the fourth-largest public Bitcoin holding company in the world, reported a loss of $619 million for the fiscal year.

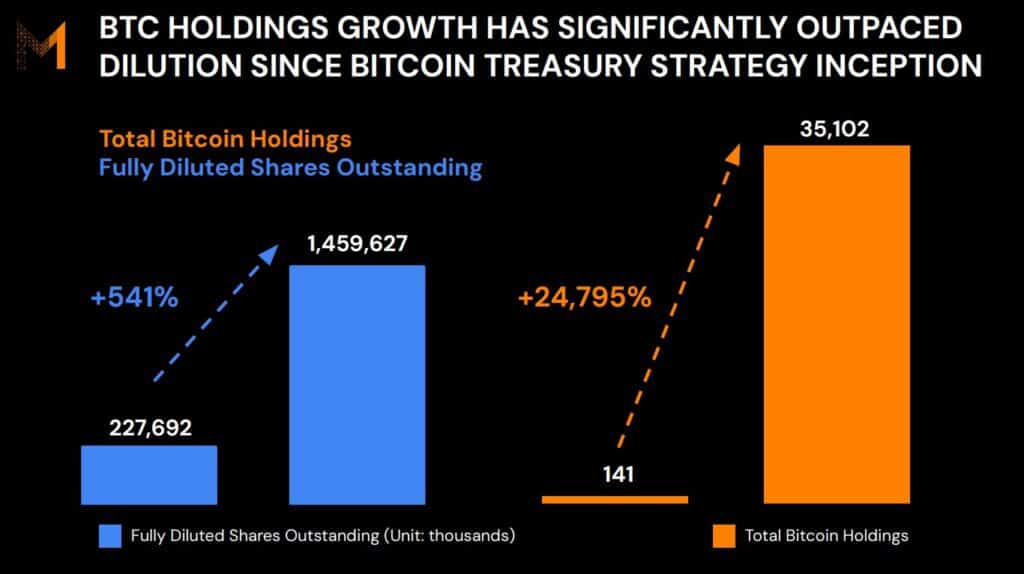

But here’s the twist! They are not selling. Instead of folding, the company has aggressively increased its Bitcoin reserve to 35,102 BTC. Additionally, Metaplanet has reaffirmed its long-term goal of owning 1% of the total Bitcoin supply, or 210,000 BTC.

On February 16, 2026, Metaplanet CEO Simon Gerovich took X to reveal forecasts for fiscal year 2026, which include +80% year-on-year revenue and +81% year-on-year operating profit.

Metaplanet reported a net loss of 102.2 billion yen ($665.8 million), mainly due to a decline in the value of its Bitcoin holdings. While paper losses dominated the balance sheet, Metaplanet’s core operations prospered. Revenue rose 738% to 8.91 billion yen ($58 million) from 1.06 billion yen a year earlier.

“We launched the Bitcoin Income business in the fourth quarter of 2024. Since then, this strategy has become our primary source of revenue and is expected to continue to be a primary driver of earnings growth.” the company said.

Source: Metaplanet

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

Metaplanet continues to buy the dip

Just like when MicroStrategy stock faces pressure during market crises, Asia’s MicroStrategy, also known as Metaplanet, is seeing red ink because Bitcoin’s current price is lower than its average purchase price of about $107,000.

Currently, Bitcoin is struggling to maintain $68,000.

But don’t be fooled by the headlines: although the valuation is low, they are sticking to the plan.

Metaplanet reported an unrealized loss of $664 million in Bitcoin for fiscal 2025.

But look closer:

➤ $BTC holdings increased from 1,762 → 35,102 BTC (now 4th largest public holder)

➤ Revenue increased 738% year-on-year

➤ Profit increased 1,694% year-on-yearThe engine of growth? Bitcoin options trading, not price gains.… pic.twitter.com/ksW1uZPruh

– Crypto Patel (@CryptoPatel) February 17, 2026

Despite the paper losses, they are buying the dip. They ended the year with 35,102 BTC, an increase of 1,892% from the previous year. This mirrors how Strategy reported earnings during similar crises – ignore the paper valuation and keep racking up sats.

Metaplanet continues to target 210,000 BTC by 2027 through its “555 Million Plan.”

The company even noted that its balance sheet is “robust” enough to survive even if Bitcoin drops another 86%, showing that they are prepared for extreme volatility.

DISCOVER: The top 20 cryptocurrencies to buy in 2026

Key takeaways

-

Asia’s MicroStrategy, also known as Metaplanet, is seeing red because Bitcoin’s current price is lower than its average purchase price of about $107,000.

-

Metaplanet foresees 210,000 BTC by 2027 through its “555 Million Plan,” betting on Japan’s idle savings of $7 trillion in fuel.

The post Metaplanet Continues to Buy the Dip Despite $619M Net Loss Driven by Bitcoin Writedowns appeared first on 99Bitcoins.