Dive summary:

- Federal regulators have given the green light to eight proposals from drug makers to enact rebates in 340B, changing how savings in the massive drug discount program are typically divided among providers.

- He The approvals were released by the Health Resources and Services Administration.the HHS agency that oversees 340B, on Thursday. They include frequently prescribed drugs made by companies such as Bristol Myers Squibb and Johnson & Johnson, two drugmakers that sued the government after it prevented them from implementing their own 340B reimbursement plans.

- Hospital groups criticized the model approvals for benefiting drugmakers at their expense, with America’s Essential Hospitals calling it a “clear case of the fox guarding the chicken coop.”

Diving information:

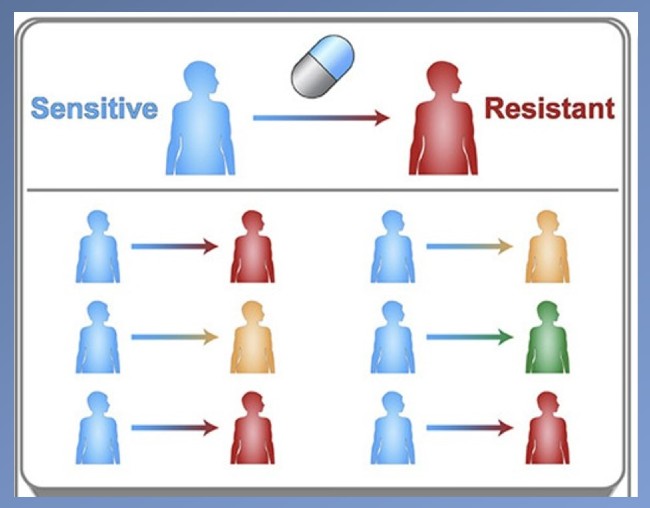

The Trump administration announced in August that it would pilot a $340 billion reimbursement program next year to the horror of hospitals. Allowing drug makers to issue rebates rather than up-front discounts on eligible drugs will force providers to float revenue, impacting their ability to provide patient care, according to industry groups.

However, HRSA officials and drug makers argue that the pilot is intended to address concerns about fraud and abuse in 340B, a program formed three decades ago to help cash-strapped providers serving vulnerable patients pay for prescription drugs whose size and spending have since skyrocketed.

Under the pilot program, 340B providers will purchase medications through their wholesale account and request reimbursement for the medications when they are dispensed to eligible patients, rather than receiving the discount when purchasing the medication.

Covered providers will have to disclose data to support a dispensed drug’s eligibility for 340B savings, including the claim number, prescriber ID, and 340B provider ID, to an IT platform called Beacon.

Beacon will then verify eligibility, including that a drug was dispensed at a 340B-eligible location and that the claim was submitted on time, before participating drug manufacturers will issue rebates for the difference between the wholesale price and the lower 340B price.

Once approved, drugmakers must pay rebates within 10 days. According to HRSA, any company that frequently delays payments could have its reimbursement model approval revoked.

Drugs Approved for the 340B Reimbursement Model Pilot Program

Hospitals say tracking and submitting this additional data will require time and money that many facilities do not have. Participating providers are also concerned that drug manufacturers will find excuses to deny valid rebates and avoid disbursing discounts.

“Hospitals now have to manage a whole new set of administrative burdens, requiring more bureaucracy and more paperwork, with no benefit to patients’ ability to access discounted medications,” America’s Essential Hospitals CEO Jennifer DeCubellis said in a statement Thursday.

“Drug manufacturers are the only winners with these reimbursement models,” he said.

The handful of drugs that will be subject to rebates starting Jan. 1 represent a huge amount of sales. For example, plaque psoriasis treatment Stelara is one of Johnson & Johnson’s most expensive and frequently prescribed medications. Stelara sales reached $10.4 billion last year, accounting for nearly 12% of the company’s total revenue, according to financial documents.

Similarly, Bristol Myer’s blood thinner Eliquis is the company’s top seller, with $9.6 billion in US sales Last year, more than 28% of the pharmaceutical company’s total income in the states. Novolog and fast-acting insulins Fiasp represents a smaller percentage of Danish giant Novo Nordisk’s sales, but remains one of the most prescribed insulin products in the US.

That union between the expensive and the commonly prescribed is the reason why all the drugs on the list were selected for Medicare price negotiations two years ago. Revenue from the products could rise even further if its $340 billion rebates decline, one reason drugmakers have lobbied hard and filed lawsuits to restrict the program.

HRSA said it may consider expanding the 340B reimbursement pilot program to other drugs that Medicare is not negotiating in the future.