After weeks, or days, of unpleasant positioning, something we hoped for was achieved last night. A relief. A preferable geopolitical condition flipped the script, sending US stocks soaring while cooling an overheated rally in gold, and giving the green light to the long-awaited Bitcoin and cryptocurrencies. Or is it green light?

Yes, the three of them arrived early this morning. The Bitcoin rally got a bid, US stocks plummeted, and gold politely retreated a bit.

Trump’s speech in Davos was the one that drove most of it. By ruling out force on Greenland and instead proposing a NATO-based framework, he unleashed a geopolitical scare. Trump has also doubled down on making the United States the global hub for digital assets and sparked accelerated crypto legislation.

But that’s not all: tariffs are also being eliminated, at least for now.

The Case of Crypto Bull Run: Will Bitcoin Recover After US Stocks?

Somewhere between praising America’s economic dominance and mixing Greenland with “Iceland,” Trump leaned toward optimism. The declines were “minor,” the markets were going to “double,” and the United States was open for business.

Was it effective?

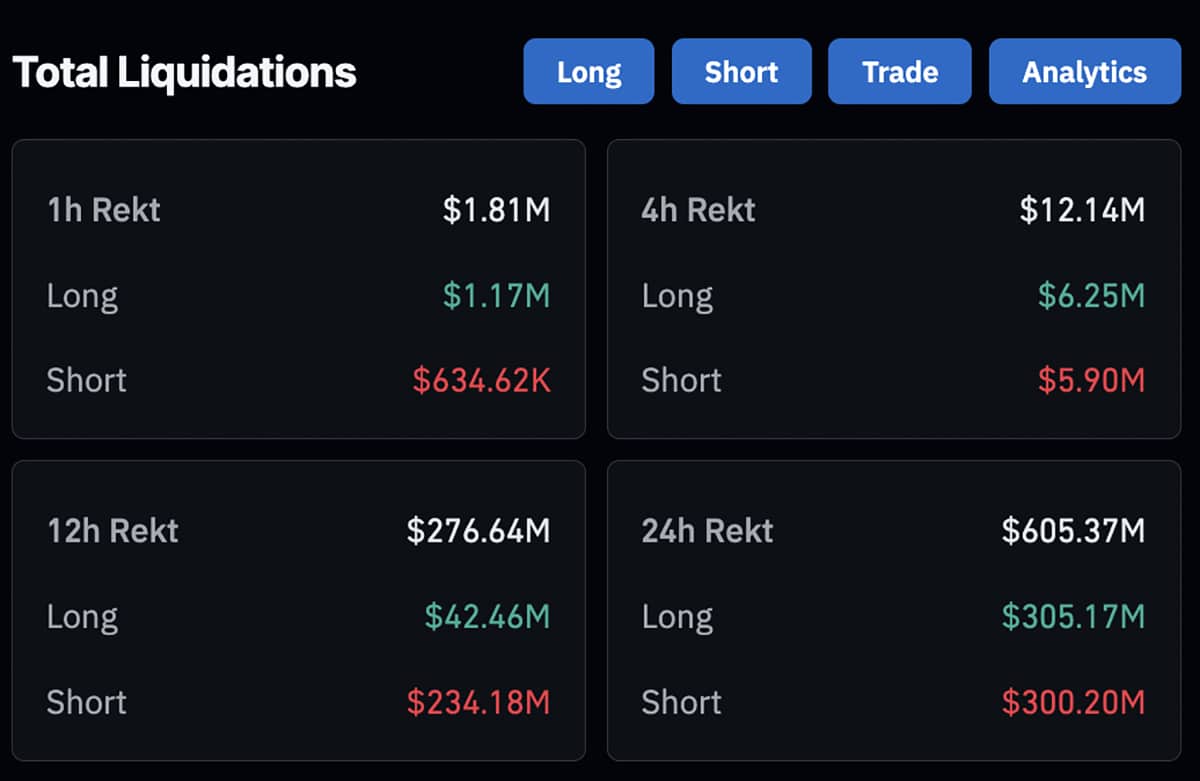

Bitcoin rose to $90,000, Ethereum surpassed $3,000, and sentiment went from cautious to neutral in a matter of hours. Liquidations reached $606 million, split almost equally between long and short positions, because cryptocurrencies love to punish everyone equally in this cycle.

(fountain – glass coin)

Behind the scenes, the CFTC launched its “Future-Proof” plan, pushing Congress to finally modernize the rules on digital assets. Trump’s AI and cryptocurrency czar floated the idea of banks and stablecoins playing better together. Even the American Bankers Association weighed in, nervously waving red flags about yields. I think Brian Armstrong has a strong argument here.

ONLY IN:

Coinbase CEO Brian Armstrong calls out French Central Bank Governor’s misunderstanding of Bitcoin.

"Bitcoin is a decentralized protocol… Bitcoin is more independent." pic.twitter.com/k7WNsBrgAP

— Watcher.Guru (@WatcherGuru) January 21, 2026

Meanwhile, U.S. stocks did what U.S. stocks do when there’s no planned apocalypse. The Dow Jones jumped 588 points, the S&P 500 gained 1.16% and the Nasdaq added 1.18%, erasing more than half of recent losses in a single session.

Supply chains breathed easier, multinationals captured a bid and risk assets across the board followed stocks higher. Bitcoin is having its rally as the bottom price may already be discounted. We can only hope that cryptocurrencies join the US stocks sprint.

DISCOVER: More than 10 cryptocurrencies that will multiply by 100 in 2026

Gold and maybe some important random news

The gold rally, which had been acting as if World War III was really about to arrive, finally began to take hold. Its price was set at $4,891 per ounce before falling to around $4,772 as uncertainty cooled. Silver followed suit, pulling back after hitting $95. Gold lovers made profits, volatility subsided, and cryptocurrencies were finally able to have their moment as capital deployment rotates.

BREAKING: GOLD AND SILVER AFTER TRUMP CANCELS EU TARIFFS pic.twitter.com/jlD1FrvNjR

– Coin Bureau (@coinbureau) January 22, 2026

Moving on to other news, Iran reportedly accumulated over $500 million worth of Tether USDT to secure its currency, reminding us how important stablecoins are. BlackRock, on the other hand, doubled down on cryptocurrencies and tokenization as long-term drivers, while Solana dominated DEX volumes with a stable price and XRP posted poor output numbers.

The headline now is “no war”, there is no World War III yet. US stocks are rising. The gold rally is cooling off as we wait for Bitcoin.

“Bitcoin is a decentralized protocol. There is actually no issuer of it. So in the sense that central banks have independence, Bitcoin is even more independent. There is no country, company or individual that controls it in the world.” – Brian Armstrong during Davos

DISCOVER:

- 16+ New and Upcoming Binance Listings in 2026

- 99Bitcoins Q4 2025 State of the Crypto Market Report

Follow 99Bitcoins on unknown For latest market updates and subscribe on YouTube For expert daily market analysis.

There are no live updates available yet. Come back soon!

The post Crypto Market News Today, January 22: No War? Gold Consolidates, US Stocks Run, and Bitcoin Rally May Finally Begin appeared first on 99Bitcoins.

Coinbase CEO Brian Armstrong calls out French Central Bank Governor’s misunderstanding of Bitcoin.

Coinbase CEO Brian Armstrong calls out French Central Bank Governor’s misunderstanding of Bitcoin. BREAKING: GOLD AND SILVER AFTER TRUMP CANCELS EU TARIFFS

BREAKING: GOLD AND SILVER AFTER TRUMP CANCELS EU TARIFFS