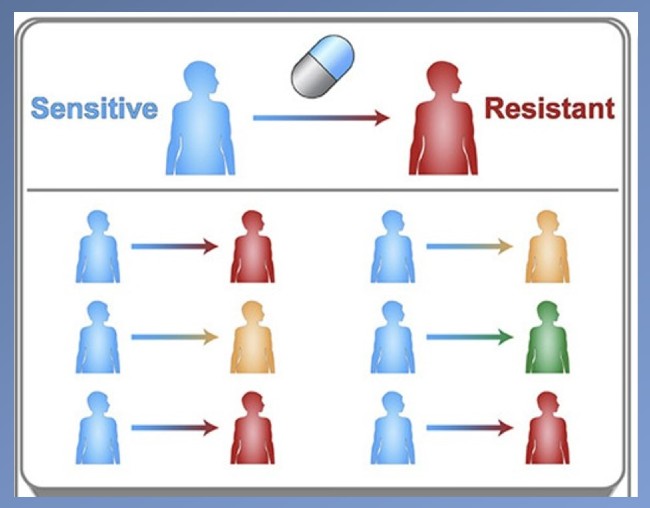

Over the past two decades, American hospitals have absorbed nearly $745 billion in uncompensated care, according to the American Hospital Association. This burden continues to grow as hospitals struggle to verify active insurance. The task becomes more difficult because patients frequently change jobs, relocate and move through a fragmented payment system that providers must track and interpret. The result? Missed billing opportunities, delayed payments and unnecessary cancellations threaten not only the hospital’s financial stability, but also its ability to provide care to its communities.

Now, the recently enactedLaw on a big and beautiful bill” adds even more pressure. With sweeping Medicaid cuts and stricter eligibility rules, millions of Americans could lose coverage and hospitals could face a sharp increase in uncompensated care. Key provisions include:

- More frequent eligibility reviews (every six months instead of annually)

- Higher out-of-pocket costs (up to $35 per doctor visit)

- New limits on state Medicaid funding (including provider tax bans)

According to the Congressional Budget OfficeIt is estimated that 11.8 million people could lose Medicaid coverage by 2034. These changes shift greater financial responsibility to hospitals and patients.

But the impact is not only financial. For patients, undetected coverage can lead to surprise bills, postponed treatments, or even collections, all of which erode trust in the healthcare system. Vulnerable populations, particularly those affected by the latest Medicaid changes, are at greatest risk of being left out.

Hospitals are committed to serving their communities, including those who may not be able to pay. To do this, they must recover every dollar to which they are entitled. That means identifying coverage wherever it exists, even when it is hidden, forgotten or misclassified.

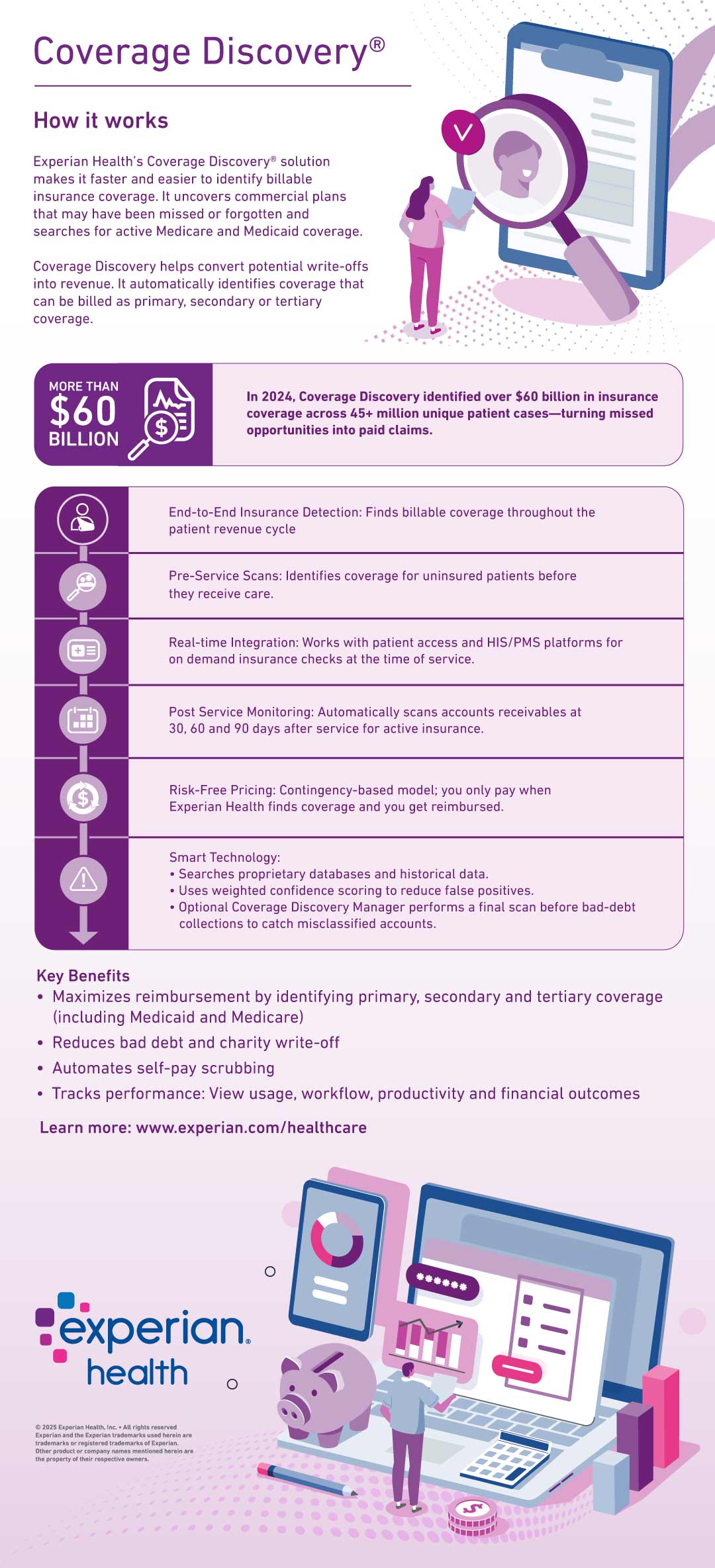

That’s where Coverage discovery come in. Experian Health’s solution uses proprietary data and advanced machine learning to identify unknown or forgotten insurance coverage throughout the revenue cycle: before, during and after care.

Unlike traditional eligibility checks, Coverage discovery it goes deeper. Scan commercial, government and third-party payers in real time; Uncovers primary, secondary and even tertiary coverages that might otherwise go unnoticed. This proactive approach helps providers bill the right payer the first time, reducing denials, expediting reimbursements, and minimizing bad debt.

Coverage discovery identified on $60 billion in insurance coverage in more than 45 million unique patient cases in 2024 alone, turning missed opportunities into paid claims.

In times of uncertainty, clarity is essential. Coverage discovery allows providers to take control of the coverage gap, not just react to it. By bringing hidden coverage to light early and often, hospitals can protect their financial health while improving the patient experience.

Here’s how it all comes together: