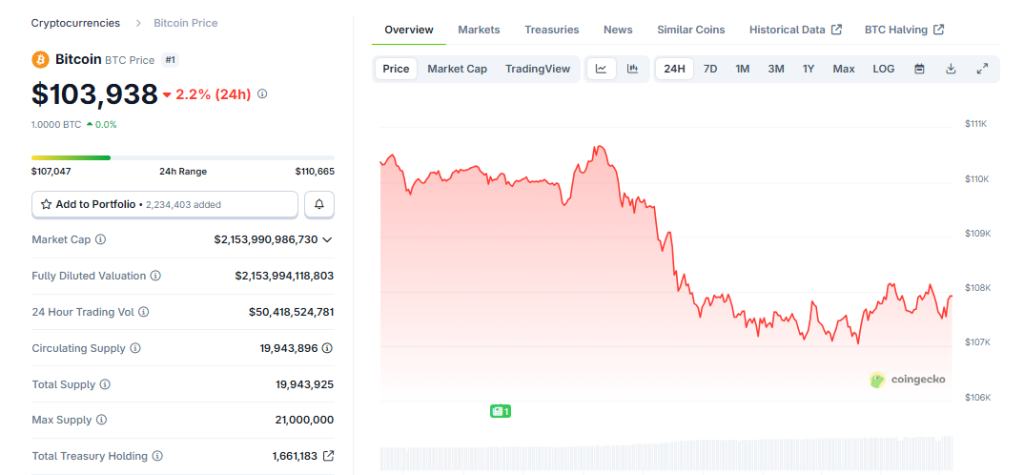

Bitcoin’s pullback on Monday caused a rapid cooldown in crypto markets, reducing sentiment to levels not seen in months. Prices dropped within 24 hours. minimum of $103,938 after previously trading above $109,000, and market mood indicators turned sharply negative as investors reassessed risk.

Related reading

Fear of cryptocurrencies reaches extreme readings

According to the Crypto Fear & Greed Index, the score fell to 21 out of 100 on Tuesday, a move that registers as “Extreme fear.”

That mark is the lowest in almost seven months; The index previously reached 18 out of 100 on April 9, when markets reacted to US President Donald Trump’s global decision. tariff measures.

Reports have revealed that the index has been oscillating between calm and alarm since the big sell-off in early October, when readings fell after prices fell from a high of over $126,000 on October 6.

Market participants pointed to a combination of weak institutional flows and macroeconomic concerns. Bitcoin-linked exchange-traded funds reportedly recorded net outflows of nearly $800 million last week.

Analysts said institutional purchases recently fell below the amount of newly mined Bitcoin for the first time in seven months. Those trends reduce the steady inflows that had helped support prices.

Price Action and Short-Term Driving Factors

Bitcoin recovered above $104,100 after the low, but the sharp intraday swing highlighted the fragility. Some traders blamed stock markets and wallets for the cooling activity, while others flagged concerns about the Federal Reserve’s stance.

The Federal Reserve cut interest rates for the second time this year on Wednesday, but signaled that there may be no further cuts in 2025. That hint of a less accommodative outlook appeared to catch investors off guard, prompting a rapid repricing in both the stock and cryptocurrency markets.

There are also technical points at stake. The Crypto Fear & Greed Index last fell into the “extreme fear” zone on October 21, when it hit 25 out of 100, after Bitcoin fell from over $110,000 to below $108,000.

Previously, the index had surpassed 70 (a “greed” reading), showing how quickly sentiment can change when price movements accelerate.

Related reading

What traders are watching next

Traders will be watching ETF Flowschain activity and any new signals from US policymakers. Lower blockchain activity and fewer major purchases by institutions have reportedly been cited as immediate reasons for the decline.

If inflows return, they could stabilize the market. If the leaks continue, the pressure may increase.

However, market bulls are still pointing to a seasonal story. Based on historical patterns cited by some analysts, November has often been a strong month for Bitcoin, with average gains of over 40% in recent years.

Featured image of Gemini, TradingView chart