Data shows that the Bitcoin Fear & Greed Index has returned to the neutral zone after the cryptocurrency’s price recovery.

Bitcoin Fear and Greed Index Now Values 51

The “Fear and Greed Index” refers to an indicator created by Alternative which measures the average sentiment present among traders in Bitcoin and the broader cryptocurrency markets. The metric uses data from the following five factors to determine investor mindset: trading volume, market cap dominance, volatility, social media sentiment, and Google Trends.

The index uses a numerical scale ranging from zero to one hundred to represent this sentiment. All values above 53 correspond to investor greed, while those below 47 correspond to fear. The region between the two limits naturally corresponds to a purely neutral mentality.

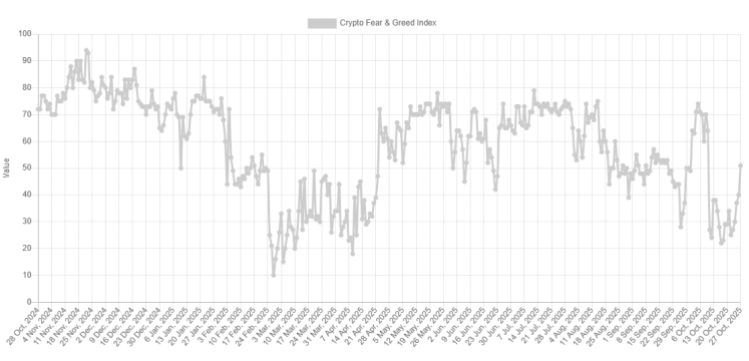

Now, here’s what the current Bitcoin market sentiment looks like, according to the Fear & Greed Index:

As can be seen above, the indicator has a value of 51, suggesting that trader sentiment is almost exactly in balance at the moment. This is a notable change in market mood compared to just a few days ago.

As shown in the chart, the fear and greed index was within the fear zone for the past few days. The desperation among traders was a result of the bearish price action that BTC had recently faced.

At one point, the indicator even fell to a low of 22, reflecting a state of “extreme fear.” This area, which is below 25, corresponds to investors being the most bearish towards the market. There is also a similar region for the greed side, called “extreme greed,” located above 75.

Historically, extreme sentiments have been quite significant for Bitcoin and other cryptocurrencies, as it is where the major highs and lows have tended to form. However, the relationship has been reversed, meaning that extreme fear is where bottoms form, while extreme greed facilitates tops.

Since the extreme fear low at the beginning of the month, BTC has been rising, a possible indication that the contrary sentiment signal may be in action again.

The cryptocurrency has extended its recovery sharply over the past few days, which may be a possible reason why the Fear & Greed index has now returned to neutral territory.

Although, for now, Bitcoin traders are still undecided whether the bullish action will follow next. It now remains to be seen whether they will embrace greed or continue to doubt the recovery.

BTC Price

At the time of writing, Bitcoin is trading around $114,900, up 3.6% over the last seven days.