- Tokenized US and non-US Treasuries added $2.12 billion in market capitalization in the first two months of 2026, while stablecoins are lagging behind with an increase of $1.19 billion.

- The first quarter of 2026 is already on track to become the strongest quarter on record for tokenized Treasuries.

- Yielding stablecoins dominate stablecoin supply growth in 2026, partially offsetting billions in losses from USDT and USDC.

Stablecoins have historically eclipsed tokenized Treasuries in most cases, with their quarterly supply expansion regularly reaching tens of billions. However, so far in the first quarter of 2026, the tokenized treasury market added $2.12 billion in market cap, while stablecoins added only $1.19 billion. For the first time, tokenized Treasuries are growing faster than stablecoins in absolute terms.

So what changed?

Note: Data for the first quarter of 2026 is as of February 24, 2026.

The market became cautious and yield became the answer

Crypto markets have been through a difficult period and investors are responding by rotating towards assets that offer more stability and predictable returns. Tokenized Treasuries fit that profile almost perfectly: They are backed by US government debt and generate a real yield, which has even increased slightly this year.

Tokenized Treasuries Currently Showing eight consecutive quarters of expansion. Plus, even though we’re only halfway through the quarter, The first quarter of 2026 is already on track to become the strongest quarter on record for tokenized Treasuries. This indicates that demand is not only maintaining, but also accelerating.

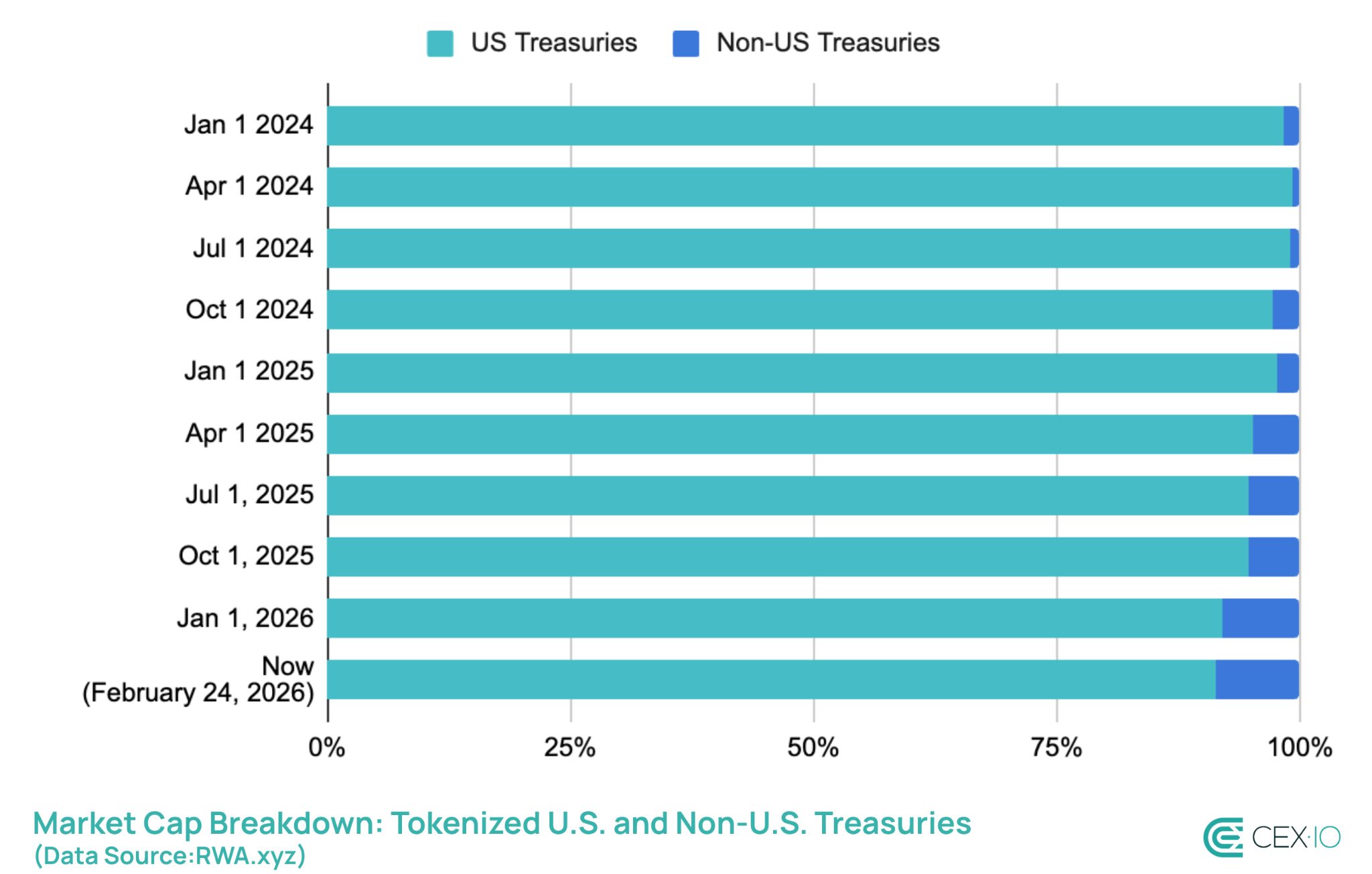

As such, since early 2024, tokenized US Treasuries have grown from $750 million almost $11 billion – an increase of approximately 15 times. Non-U.S. Treasuries followed a similar trajectory, rising from just $13 million to more billion dollars during the same period.

In particular, non-US Treasuries have been steadily increasing their footprint within the tokenized Treasury bond market. Its share of total market capitalization has expanded from about 1% two years ago to nearly 9% today, indicating a gradual diversification away from U.S. bonds.

Stablecoin Supply Is Also Moving Towards Yield

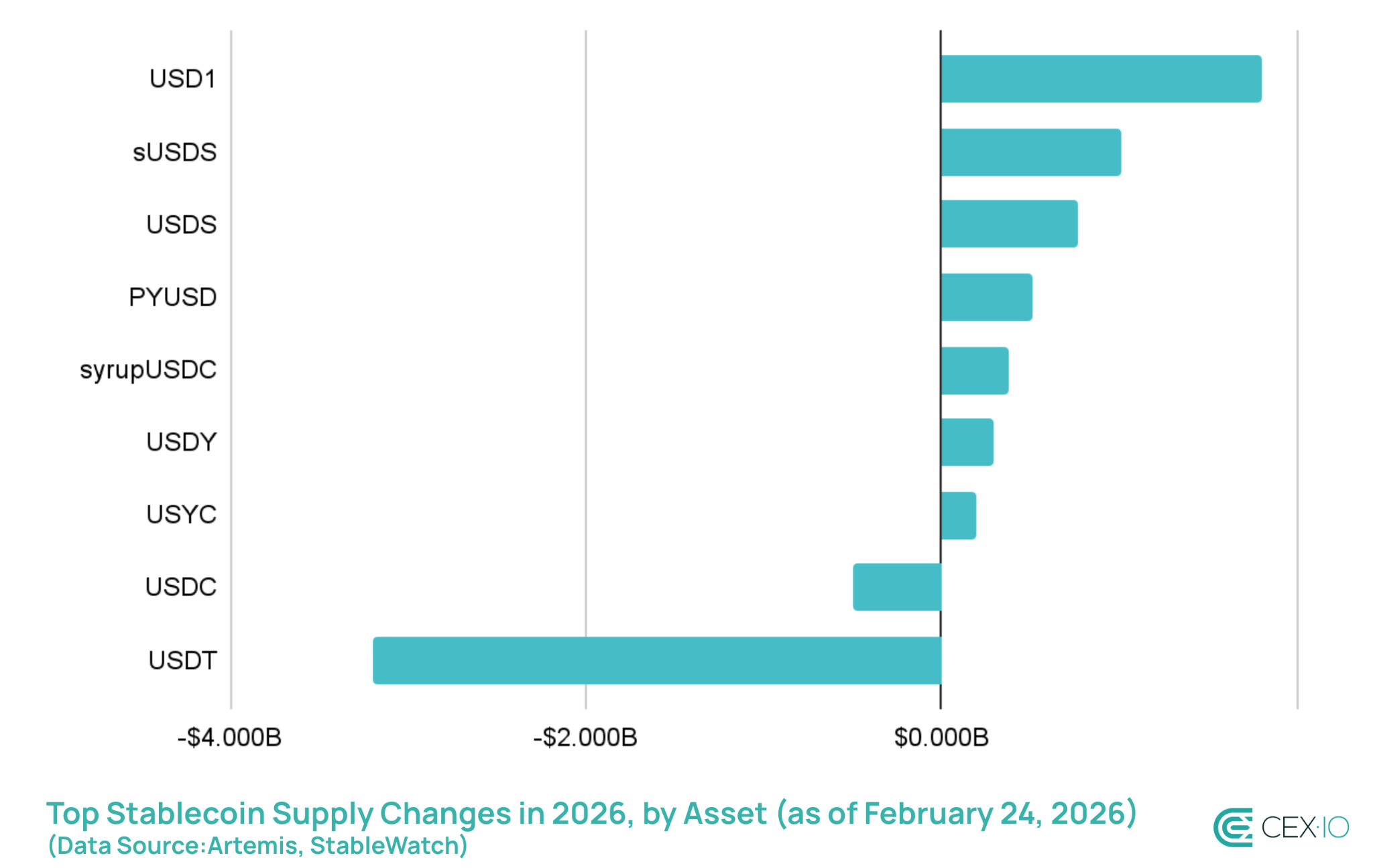

The supply of stablecoins is currently showing its worst dynamics in years. In the first two months of 2026, Ethereum Has Already Lost Over $8 Billion in Stablecoin Supply – the worst result since the second quarter of 2022. In turn, USDT and USDC lost $3.2 billion and $500 million in supply, respectively, so far this year.

By conventional measures, this would indicate a sector in retreat. But the total supply of stablecoins has barely changed overall, because the market is restructuring around performance.

Among the stablecoins that will post the largest absolute supply gains in 2026, yield-generating assets like USDY, USDS, USYCand syrupUSDC lead the pack. Other high-performing countries are also closely linked to performance-generating mechanisms. USDfor example, it largely serves as an entry point to sUSDS, while 1 dollar has benefited from the launch of World Liberty Markets, which expanded its DeFi utility and access to yield. So even when the performance is indirect, it is clearly driving adoption.

Overall, the performing stablecoins showed a 5% increase in 2026 so far, becoming the best performing segments in the stablecoin sector at the moment.

What this means for the industry

During bull markets, stablecoins thrive as liquidity vehicles, staying clear of active speculation. In a more cautious environment, idle capital comes at a cost, and both protocols and users look for harder-working on-chain instruments. If bearish conditions persist, yielding stablecoins and tokenized Treasuries are well positioned to continue expanding as investors seek stability and consistent returns.

The growth of profitable assets is already being recorded beyond the crypto markets. In Washington, stablecoin performance has become one of the most contentious issues in ongoing US crypto legislation. Specifically, it is about whether centralized exchanges should be allowed to pay yield on stablecoin balances, a model that banks see as a direct threat to their deposit business. That debate is more limited than the native DeFi yield products discussed here represent, but it reflects the same underlying shift: cryptoasset yield is no longer a niche feature, but is becoming an expectation, and one that traditional finance is taking seriously enough to reject through legislation.

The web content provided by CEX.IO is for educational purposes only. The information and tools provided are not and should not be construed as an offer, a solicitation of an offer or a recommendation to buy, sell or hold any digital asset or to open a particular account or engage in a specific investment strategy. Digital asset markets are very volatile and can lead to loss of funds.

The availability of products, features and services on the CEX.IO platform is subject to jurisdictional limitations. To understand what products and services are available in your region, please see our list of supported countries and territories. This page includes additional links to information about individual products and their accessibility.