- Both crypto fundraising and M&A reached an all-time high in 2025 in terms of volume.

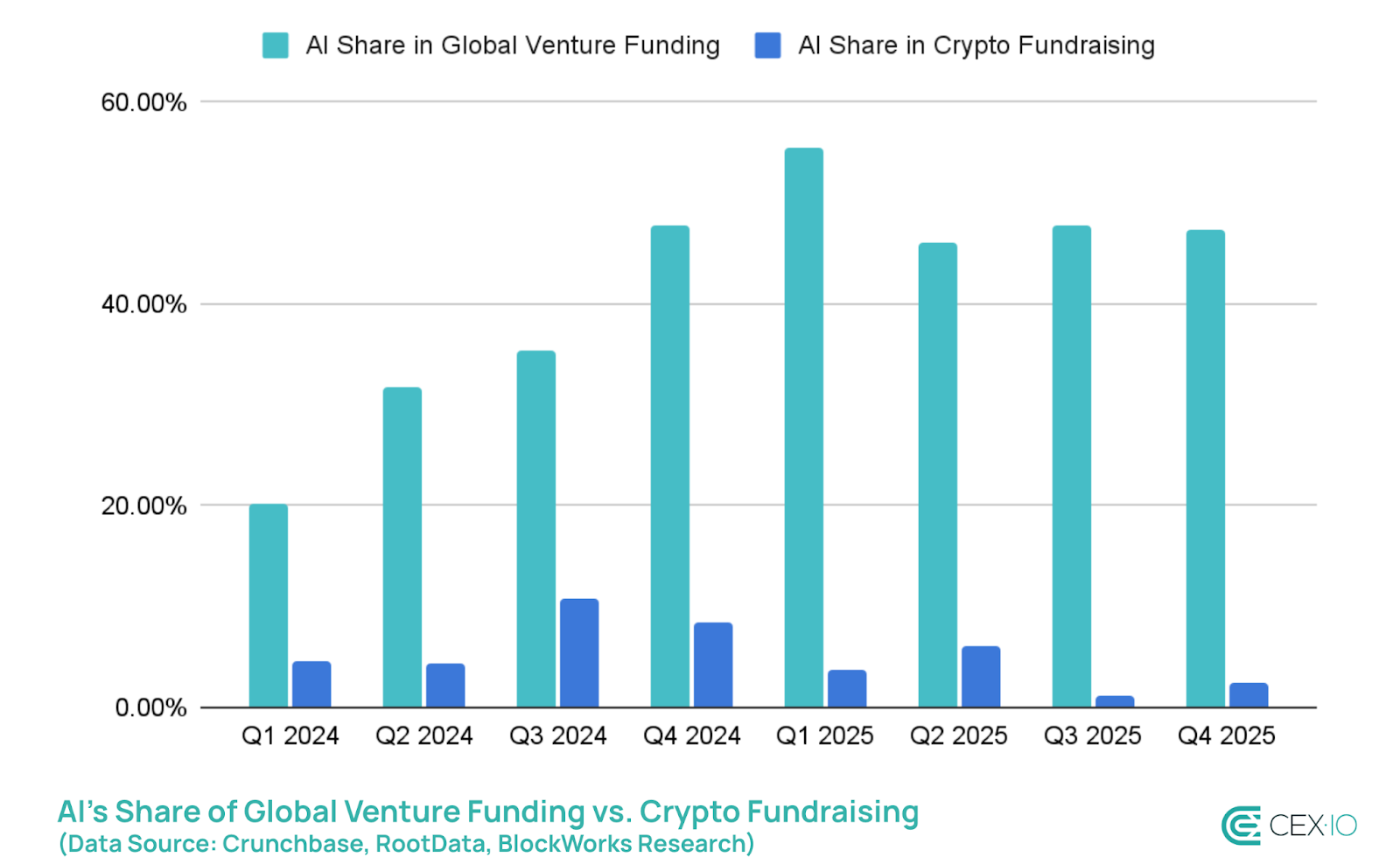

- While other industries double down on AI, their share of crypto fundraising dropped nearly threefold by 2025.

- The largest deals in 2025 were mainly mergers and acquisitions, IPOs and strategic investments from traditional financial institutions.

2025 marked a historic year for cryptocurrency trading, with combined fundraising and M&A activity reaching almost 55 billion dollars. Momentum peaked in the fourth quarter of 2025, which turned out to be the busiest quarter the industry has ever recorded. Landmark events included Naver’s $10 billion merger with Dunamu, Polymarket’s $2 billion raising led by Intercontinental Exchange, and Kalshi’s $1 billion fundraising round, which together fueled this record quarter.

Compared to 2024, the scale of cryptocurrency deals increased 350% in 2025. This increase in activity was unprecedented, nine of the ten largest crypto deals in history took place last year. The only exception in the top ten remains the $4 billion EOS ICO in 2018, which remains the largest ICO in history.

The largest deals in 2025 were mainly mergers and acquisitions, IPOs and strategic investments from traditional financial institutions.highlighting the maturation of the industry and its increasingly deeper integration with the financial system in general.

Crypto Fundraising Is Among the Leading Sectors in Global Funding

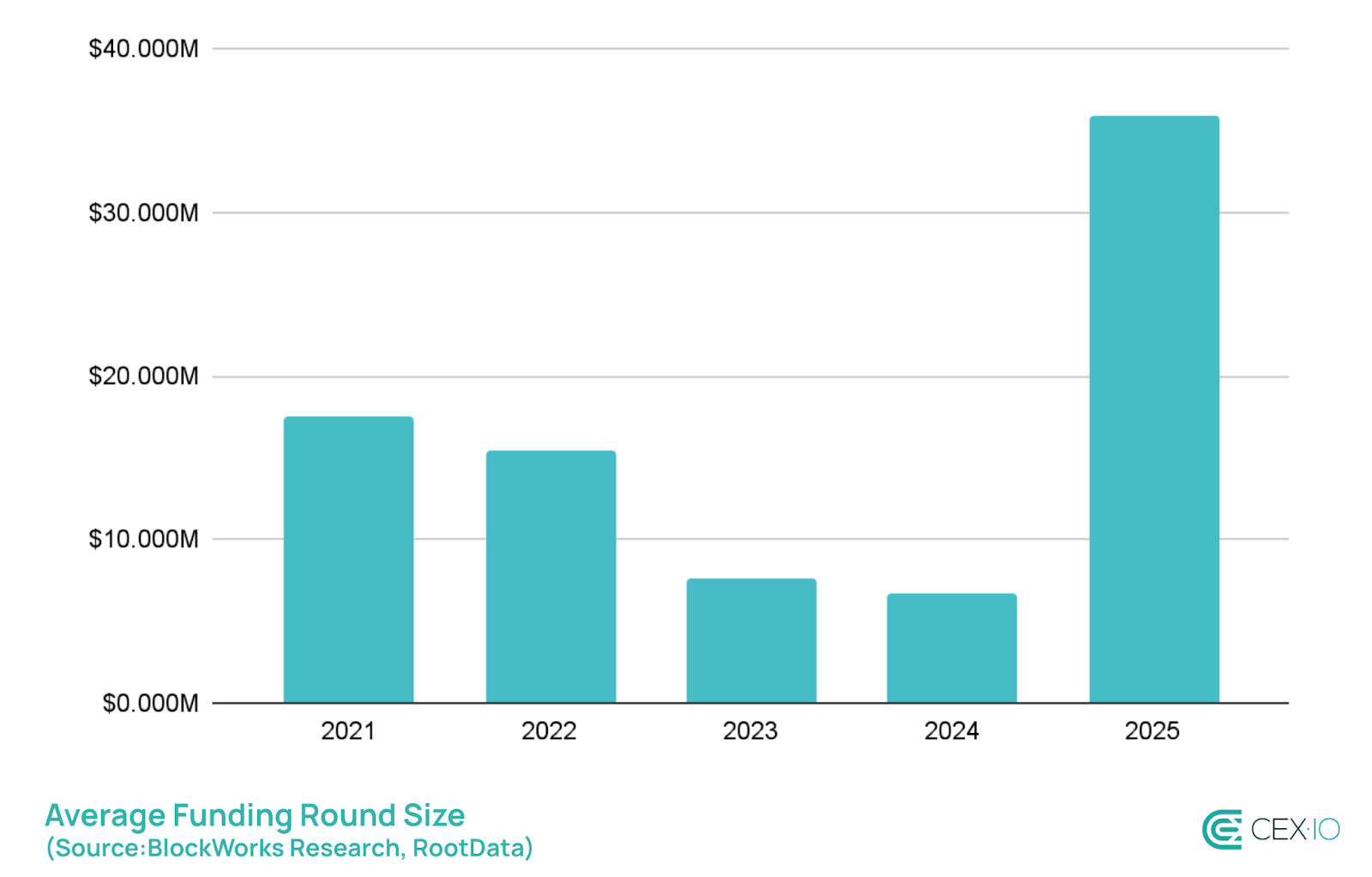

Crypto Fundraising Reached $35.6 billion in 2025, surpassing the previous peak in 2021 and setting a new all-time high. Considering Crispy Base Estimates of global venture funding last year, this would position cryptocurrencies among the top funded sectors, behind artificial intelligence and healthcare/biotech.

One of the most notable divergences between cryptocurrencies and the broader risk markets is their lower exposure to AI. While AI accounts for roughly half of all global venture funding, its share within cryptocurrencies has continued to shrink, falling from 7% of total crypto fundraising in 2024 to just 2.6% in 2025.

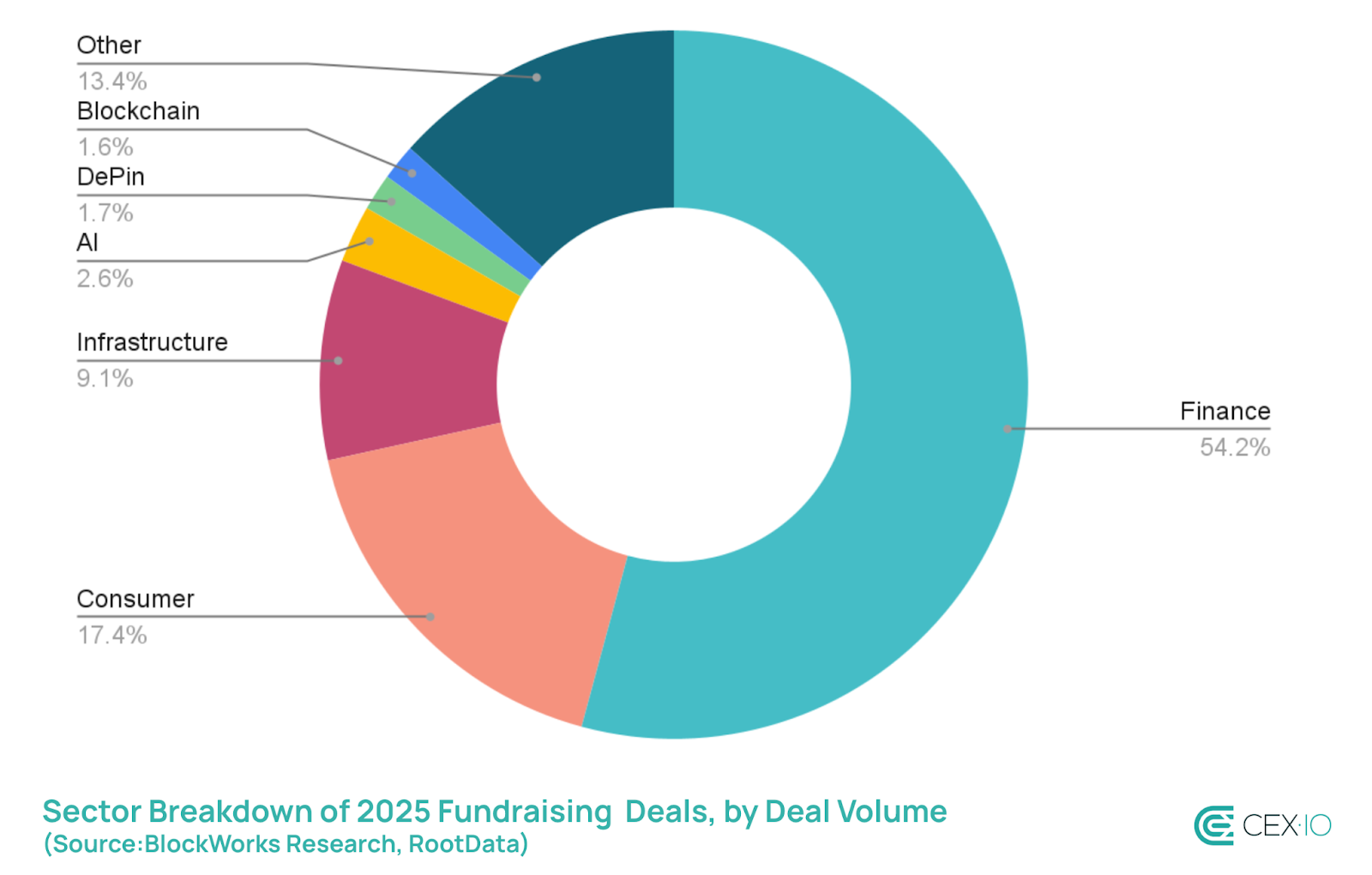

Instead of AI, the majority of funds in 2025 were allocated to finance-related projects (exchanges, stablecoins, tokenization, etc.), totaling more than $19 billion. Consumer applications (prediction markets, games, wallets, etc.) came in second place with more than 6 billion dollars, while infrastructure (hardware, security tools, bridges, etc.) completed the top three with more than $3 billion.

Another distinctive aspect of 2025 was the distribution of fundraising. Instead of spreading investments across numerous small projects, venture capitalists are now writing larger checks to fewer companies. Deal count fell 36% year after year, while the average round size increased to almost $36 millionindicating a clear preference for quality over quantity.

This dynamic reflects a broader trend across the fintech sector last year, where deals count refused by 23%even when the total transaction volume increased by 27%. However, the average size of fintech rounds stood at approximately $15 million in 2025, or approximately 2.4 times smaller than in cryptohighlighting the continued appeal of the crypto industry.

Cryptocurrency Mergers and Acquisitions Became More Common and Pronounced

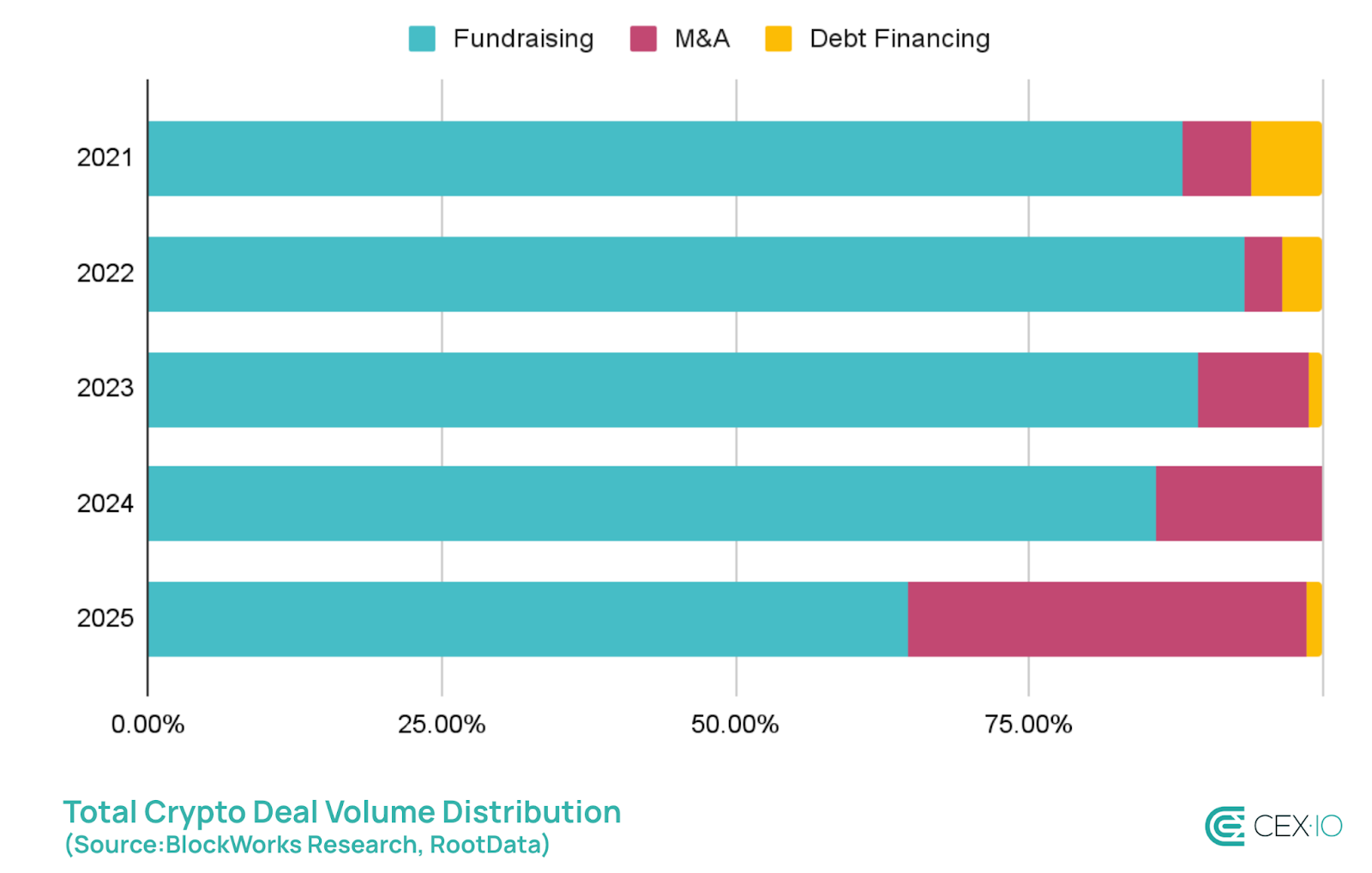

In 2025, the crypto industry saw a rapid and unprecedented increase in M&A volume and count. First, it’s important to note that M&A data is less transparent than fundraising data. While 140 cryptocurrency mergers and acquisitions recorded in 2025about 86% of them did not reveal the amount of the transaction, which makes it difficult to estimate the real value of the sector’s activity.

Still, deals with publicly disclosed securities have surpassed $18 billionrepresenting a more than 10-fold increase from 2024. For comparison, the global value of M&A reportedly increased by 40% in 2025.

As a result, mergers and acquisitions now compensate 34% of the total crypto transaction volume, the largest proportion ever recorded.

This increase in acquisitions indicates the maturation of the market. Companies are increasingly buying rather than building, acquiring existing technology, talent, and user bases to accelerate growth. The move from pure innovation to strategic consolidation suggests that the industry is entering a new phase of development.

Similar to fundraising, most known deals are found in the Finance sector, which represents 96% of the volume and 46% of the number of transactions. Notable examples include Coinbase purchasing Deribit, Kraken acquiring NinjaTrader and Ripple buy Hidden Path.

Perspectives 2026

The trends established in 2025 are likely to persist throughout 2026, but the scale of cryptocurrency deals may decline similarly to 2022 if overall market conditions deteriorate.

M&A activity is likely to accelerate as the industry continues to mature. Larger players with strong balance sheets will use market downturns as opportunities to consolidate smaller competitors or acquire strategic technologies at more favorable valuations. At the same time, fundraising patterns will likely reflect 2025’s evolution toward fewer but larger rounds overall.

Finance will most likely remain the dominant category for crypto deals in 2026, with stablecoins, tokenization, and new CeFi/DeFi projects among the most promising subcategories. Stablecoin volume and supply have been actively increasing throughout 2025, and newly established regulatory frameworks such as the Genius Act could encourage TradFi to explore stablecoin infrastructure more actively.

Tokenization and RWAs have been one of the fastest growing sectors in DeFi this year, primarily due to increased adoption of tokenized Treasuries, gold, and stocks, as well as private credit. This category is particularly attractive to investors because it serves as a practical bridge between TradFi and cryptocurrencies. On the one hand, it introduces cryptocurrency users to conventional asset classes. On the other hand, it offers traditional investors the opportunity to benefit from 24/7 trading, fractional ownership, and faster settlement times.

Overall, 2026 is likely to see an even more selective and strategically focused cryptocurrency investment landscape than 2025.

Sources

The data used for this research consists of publicly available information from RootData, Blockworks Research, Crunchbase, Lazard, and Coingecko. The observation period for this study focused on 2021-2025 for an overview and 2025 for a sector overview, with data points ending on January 1, 2026.

The web content provided by CEX.IO is for educational purposes only. The information and tools provided are not and should not be construed as an offer, a solicitation of an offer or a recommendation to buy, sell or hold any digital asset or to open a particular account or engage in a specific investment strategy. Digital asset markets are very volatile and can lead to loss of funds.

The availability of products, features and services on the CEX.IO platform is subject to jurisdictional limitations. To understand what products and services are available in your region, please see our list of supported countries and territories. This page includes additional links to information about individual products and their accessibility.