- Crypto card users increased their spending by 33% during Black Friday, with average transactions increasing by 11%, from €48 to €53..

- Jewelry, clothing and home improvement categories led Black Friday shopping, showing a triple-digit increase in transaction volume during the sales period.

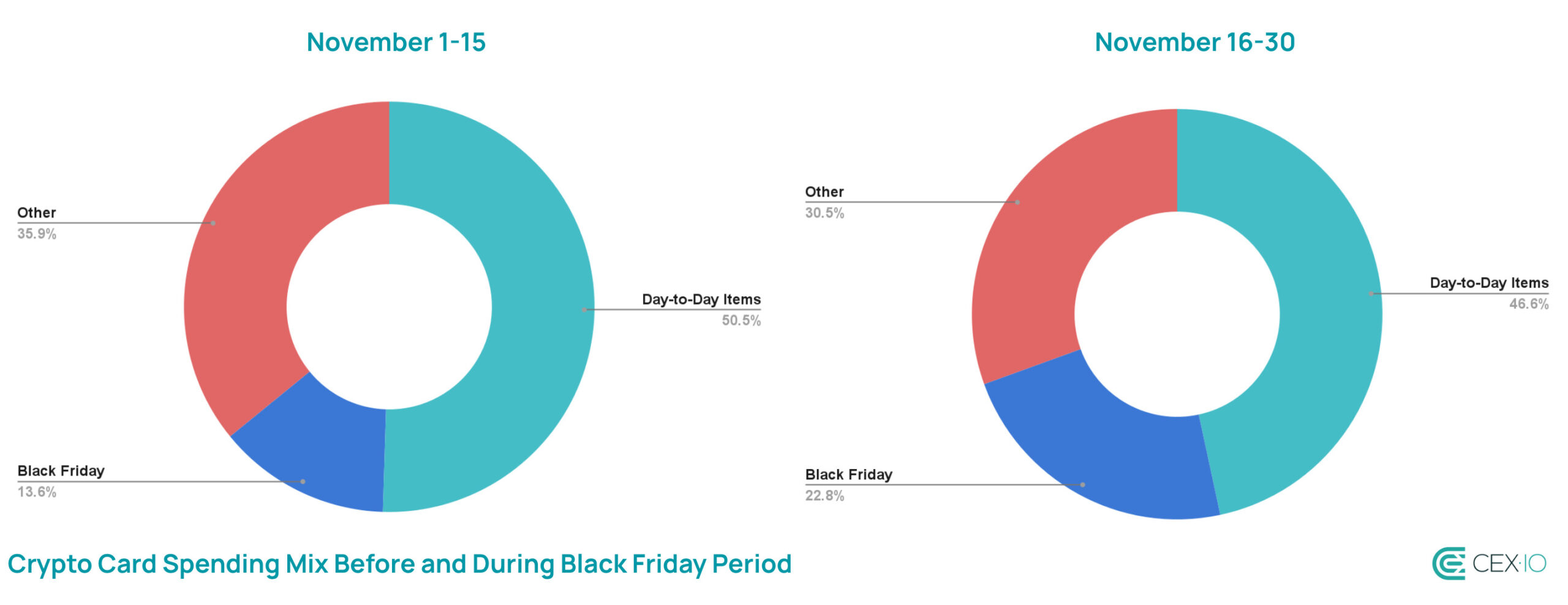

- Everyday items such as groceries and transportation continued to hold the largest share of spending, showing that crypto cards are primarily used for everyday payments, not opportunistic purchases.

According to CEX.IO internal data, transaction volumes among crypto card users increased by 33% during the Black Friday period, while the total number of transactions grew by 20%showing that Black Friday drove both higher spending and more frequent card use. The average value of transactions increased by 11% — from €48 to €53with spending expanding across most major retail categories.

At the same time, daily expenses such as groceries, transportation and daily retail remained stable, indicating that seasonal purchases did not affect usual spending habits.

Typical Black Friday categories: fashion and department stores lead the charge

Further analysis of merchant category codes (MCCs) reveals that crypto card users largely mirrored traditional consumer behavior during Black Friday, with categories that typically perform well among bank cardholders showing similarly strong results.

Fashion peaks across the board

Clothes Retailers showed one of the strongest reactions to Black Friday, recording 210% Increase in transaction volume and 35% increase in transaction count. Shoe stores followed a different pattern: volumes decreased in 17%but the number of transactions increased 13%indicating that users were looking for heavily discounted footwear rather than making larger purchases.

In general, fashion-related merchants captured more of the 7% of all spending in the Black Friday period, compared to approximately 5% average of the previous weeks.

Department stores behave “by the rules”

Department store showed a 128% increase in transaction volume and 17% increase in the number of transactions. Average transaction values nearly doubled, suggesting that users gravitated toward bundled deals and multi-item purchases that department stores traditionally promote during seasonal sales.

Hobby Supplies and Gift Shops Staying Strong

Diverse and Specialty Retail Storesspanning art supplies, hobby items and specialty products, unsurprisingly saw strong performance during the Black Friday period, with a 216% increase in volume and 18% increase in the number of transactions. Gift, card, novelty and souvenir shops experienced equally robust growth, recording a 228% jump in volume and 38% increase in transaction count.

These patterns suggest that users took advantage of Black Friday to score unique or personalized items ahead of the holiday season.

Electronics experienced purchases on a smaller scale

electronic stores presented a more complex picture, with total transaction volume falling 13%However, the number of transactions increased by 17%. This suggests that users primarily purchased lower-priced accessories rather than larger hardware.

Additionally, the relative share of electronics stores may have declined because other categories expanded much more aggressively, reducing their weight in the overall spending mix.

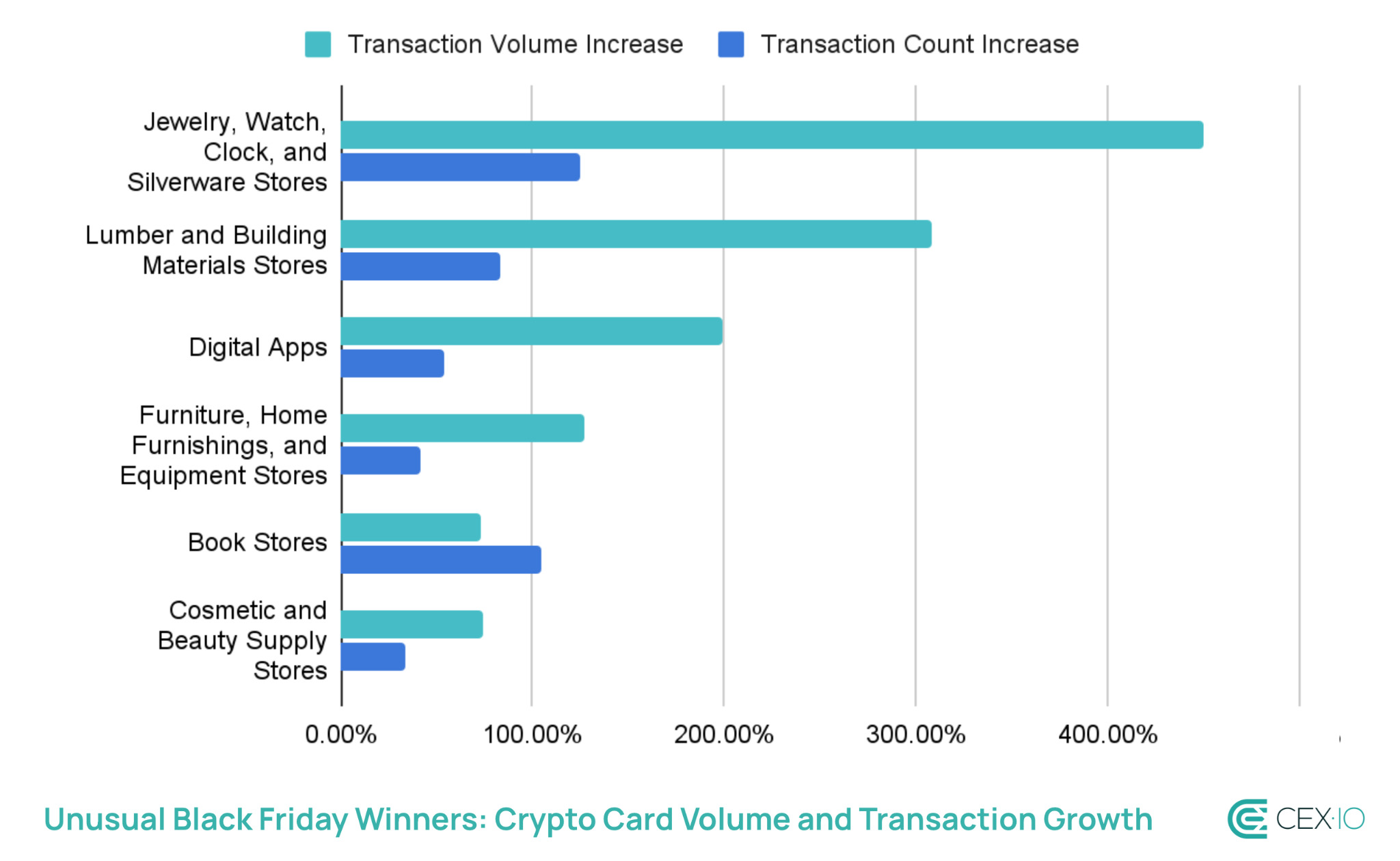

Surprising Categories: Jewelry, Cosmetics, Home Improvement and Books Exceed Expectations

Beyond the traditional Black Friday leaders, several categories returned unexpectedly strong results, revealing more diverse spending behaviors than cryptocurrency users might associate with.

Jewelry emerges beyond seasonal norms

Jewelry, watch and silver stores recorded one of the highest jumps among observed MCC codes, with transaction volume increasing more than 450% and the transaction count increases almost 125%. This raised jewelry’s share of total spending to 0.53%.

While jewelry is typically a holiday-related purchase, the magnitude of the increase suggests that users largely capitalized on Black Friday discounts for higher-value gifts and accessories.

Digital applications increase sales

Digital goods: applications saw a 199% increase in transaction volume and a 54% increase in transaction count during Black Friday. This indicates that cryptocurrency users took advantage of seasonal promotions to purchase premium app subscriptions, software packages, and digital services.

Home Updates View Momentum

Home-focused categories, including Lumber and building materials stores and Furniture, home furnishings and equipment storesregistered a 190% increase in transaction volume during the Black Friday period, respectively. This suggests that crypto card users seem to treat this Black Friday more as an opportunity to invest in home improvements, with the share of home improvement purchases exceeding 1.5% of total expenditure.

Books make a silent but strong performance

Bookstores experienced significant increases, with 73% increase in transaction volume and 67% increase in transaction count, signaling that physical and digital books are relatively popular among cryptocurrency enthusiasts as gifts or for personal consumption.

Everyday items: relatively stable despite increased Black Friday spending

Even with the increase in promotional purchases, everyday categories continued to anchor crypto card activity, demonstrating that these cards are firmly integrated into daily routines.

Groceries, convenience items and general retail continued to account for the largest share of transactions, although the share of everyday items in spending decreased slightly during the Black Friday period: 50.5% to 46.6%.

For example, Grocery stores and supermarkets represent more 18% of total transactions, and 9% in total volume. They grew by 8% during the Black Friday period, indicating that they were almost unaffected by the increase in spending during the Black Friday period.

Transportation, pharmacies and money transfers also increased, with volumes increasing between up to 40% in these subcategories. The consistency of these everyday transactions shows that crypto cards are not just used for opportunistic Black Friday deals. Cryptocurrency users keep trusting on their cards for the same everyday functional needs as bank cardholders.

Conclusion

Black Friday data demonstrates that crypto card users have successfully integrated digital payment methods into overall consumer behavior. They align more with mainstream European shopping habits and actively respond to seasonal promotions. They are also interacting more online: around 40% of all transactions during the Black Friday period were made using e-commerce platforms.

As adoption of crypto payment tools continues to grow, these behaviors suggest a future where spending with digital assets appears indistinguishable from use of any conventional card, especially during high-intensity shopping events.

Methodology

The data used for this research consists of CEX.IO card transaction records from users across the European Economic Area, where this card is exclusively available. The analysis compares a two-week period of Black Friday (November 16 to 30) with an average of two-week periods from early November and previous months. The Black Friday period was defined as November 16-30 to capture the extended sales period, as many European merchants introduced promotional pricing ahead of the traditional Black Friday week as part of their seasonal campaigns.

Transactions were classified using merchant category codes (MCCs), with each four-digit code representing a specific merchant type or industry. For analytical clarity, some MCC codes were grouped into broader categories, such as clothing, transportation, etc.

The web content provided by CEX.IO is for educational purposes only. The information and tools provided are not and should not be construed as an offer, a solicitation of an offer or a recommendation to buy, sell or hold any digital asset or to open a particular account or engage in a specific investment strategy. Digital asset markets are very volatile and can lead to loss of funds.

The availability of products, features and services on the CEX.IO platform is subject to jurisdictional limitations. To understand what products and services are available in your region, please see our list of supported countries and territories. This page includes additional links to information about individual products and their accessibility.