Do cryptocurrency prices have to increase 100x before mainstream investors take notice? Well, it seems so. After the listing of Bitcoin futures after the frenzy of 2017, everything has changed for cryptocurrencies. BTC USD price is above $110,000 and there are many more altcoins to choose from in the top 50.

It is true that promising altcoins of yesteryear, such as Dash and Iota, have faded. In their place, however, are the powers. They dominate Solana, Hedera crypto and some of the main meme coins, such as Memecore. some have 1000X-ed from its launch pricesAnd as they evolve and play a key role in the global economy, Wall Street’s big guns want a stake.

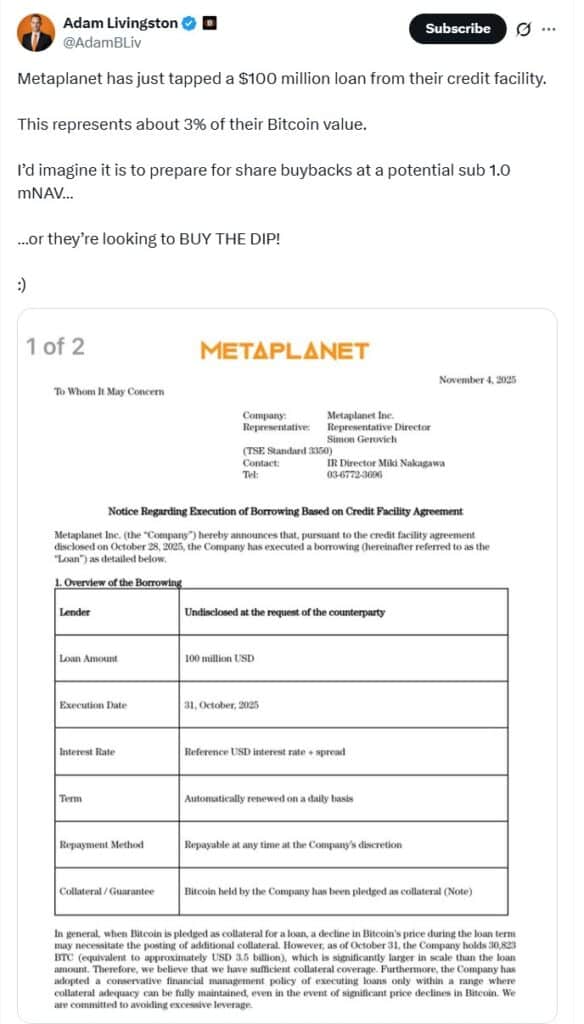

Currently, spot issuers of Bitcoin and Ethereum ETFs manage more than $180 billion and are some of the most followed regulated ETFs. Now, with the launch of multiple spot altcoin ETFs yesterday, the scene is about to change.

(Fountain: ValueBear)

DISCOVER: The best Meme Coin ICOs to invest in 2025

Altcoin ETFs Launch Hard: Over $65 Million in Trading Volume in 24 Hours

It will be difficult for any altcoin to replicate Bitcoin’s success. Being the first to act has its own advantages. Ethereum spot ETF issuers received more than $1 billion on the first day of trading.

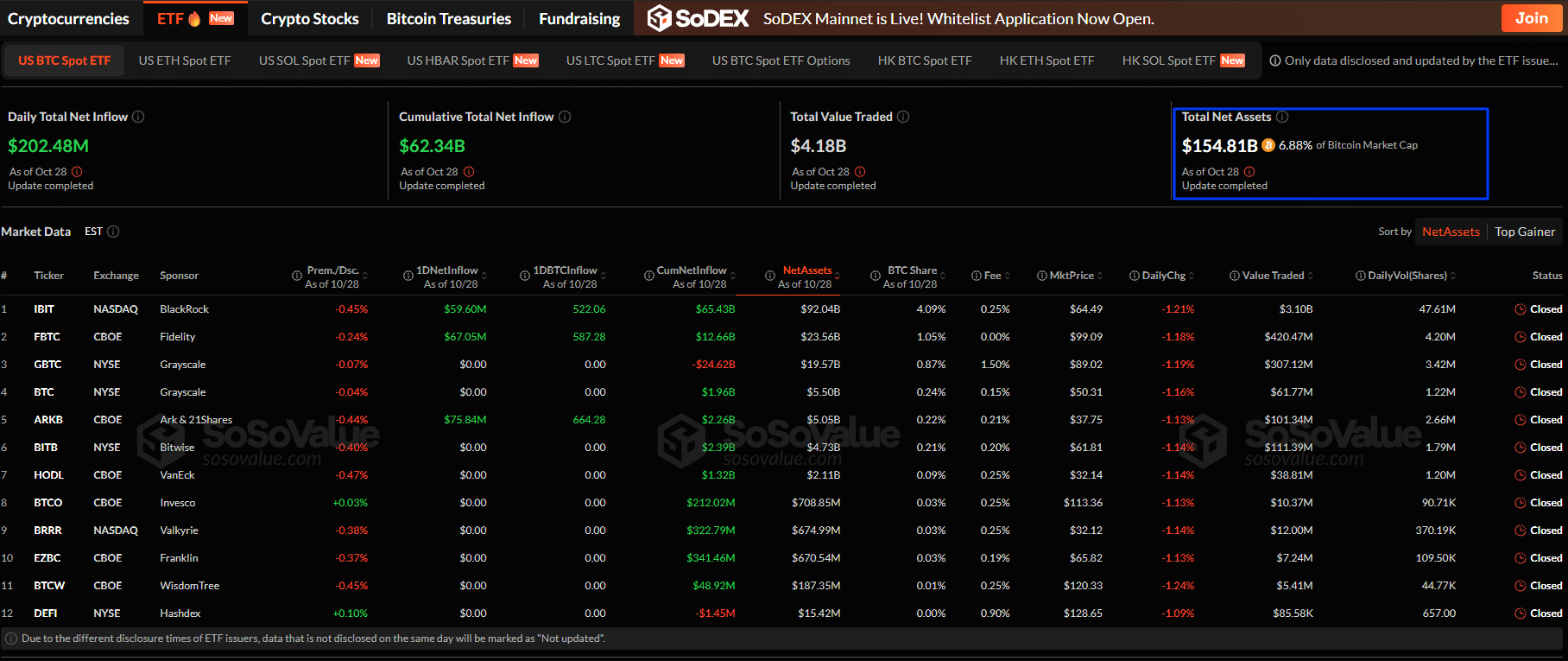

Yesterday, October 28, Bitwise Solana Stake ETF (BSOL), Canary Capital Litecoin ETF (LCC), and Canary Capital Hedera ETF (HBR) cumulatively processed over $65 million.

By any standard, this is decent and is by far the largest amount processed on the first day on any leading exchange since the approval of Ethereum spot ETFs in July 2024.

Of the three, BSOL was the most attractive. The Spot ETF offers +100% spot exposure to SOL and is designed with rewards at stake, yielding around +7% APY. It is the first spot crypto ETF in the United States that allows staking to generate returns directly in a brokerage account. More than $69 million worth of BSOL shares were traded on the first day.

ONLY IN: @BitwiseInvestThe Solana Spot ETF ($BSOL) recorded $69.5 million in capital inflows on the first day, almost 480% more than the $12 million recorded by $SSK in his debut. pic.twitter.com/1R2SaeTh1j

– Solana Floor (@SolanaFloor) October 29, 2025

Meanwhile, the LTCC and HBR ETFs also received a respectable reception, considering their relatively smaller market cap. There is no clear data, but Eric Balchunas, a crypto ETF analyst, said approximately $5 million worth of HBR shares and $4 million worth of LTCC shares were purchased.

Great day. Half an hour until publication time. Three coins will get the first Act of 33 spot ETFs. It’s time to guess the first day volume. Feel free to respond with yours, the winner will get RT + pride. here are mine… $BSOL: 52 million dollars $HBR: 8 million dollars $LTCC: 7 million dollars

– Eric Balchunas (@EricBalchunas) October 28, 2025

While much was expected, traders and analysts should note that these spot crypto ETFs were launched when the government was still partially shut down.

As such, these releases bypassed full SEC scrutiny as they used previously filed “shell” structures and review windows of 20 to 75 days. Once the government is fully operational, the SEC could impose more disclosures.

DISCOVER: 9+ Best High Risk, High Reward Cryptocurrencies to Buy in 2025

Will BTC USD price rise today after FOMC?

More BSOL shares are likely to be purchased in the future. JPMorgan analysts project between $1.5 billion and $5 billion in capital inflows in the first year alone. With more BSOL and SOL in the hands of companies, the total supply of SOL cryptocurrencies will shrink, directly driving prices.

Institutions are here for SOL.

The first US Spot Solana ETF has just launched.

Fidelity just added SOL custody.

JPMorgan analysts predict SOL ETFs could see flows of between $1.5 billion and $5 billion in the first year.

The stampede is just beginning.

— Juan León (@singularity7x) October 28, 2025

However, in the short term, SOL USD price could overcome the weakness and surpass key resistance levels. The $200 and $250 levels are critical for Solana bulls.

Still, how quickly the price of the SOL cryptocurrency will rise depends on the performance of the BTC USD price.

Like 99Bitcoins reportedthe FOMC and Jerome Powell will likely cut rates today. If so, as economists and Polymarket bettors expect, the odds of the Bitcoin price exceeding $120,000 will increase.

At X, one analyst believes Powell’s press conference will boost the market. With the bank reserves of the Federal Reserve falling below $3 trillion, he believes the central bank will end its quantitative tightening program, allowing more money into the system.

The FED’s FOMC rate cut decision will be announced tomorrow at 2:00 pm ET.

The market expects a 25bp rate cut at this meeting, so it won’t affect the market much.

What’s even more important is Powell’s speech, which will begin at 2:30 pm ET.

The job market is already… pic.twitter.com/vb1D7dYLYU

– Ash Crypto (@Ashcryptoreal) October 28, 2025

DISCOVER: 10+ upcoming cryptocurrencies that will grow 100x by 2025

Altcoin ETF Launch, Will FOMC Increase BTC USD Price?

- Bitcoin and Ethereum spot ETFs manage more than $120 billion

- A spot ETF tracking Solana, Hedera and Litecoin is available on Nasdaq

- Will the SEC issue more disclosures after the close?

- The FOMC will announce new rates today. Will BTC USD price rise?

The post Altcoin ETFs Hit $69 Million in Trading Volume as FOMC Prepares to Raise BTC USD Price appeared first on 99Bitcoins.

ONLY IN:

ONLY IN:  The FED’s FOMC rate cut decision will be announced tomorrow at 2:00 pm ET.

The FED’s FOMC rate cut decision will be announced tomorrow at 2:00 pm ET.