Bitcoin and Ethereum hold steady as ETF flows, Fed bets, and new regulatory actions keep cryptocurrencies in a holding pattern.

Bitcoin (BTC) and Ethereum (ETH) fell a bit over the past 24 hours, as BTC fluctuated around the $115,000 mark and ETH around the $4,160 mark on Tuesday.

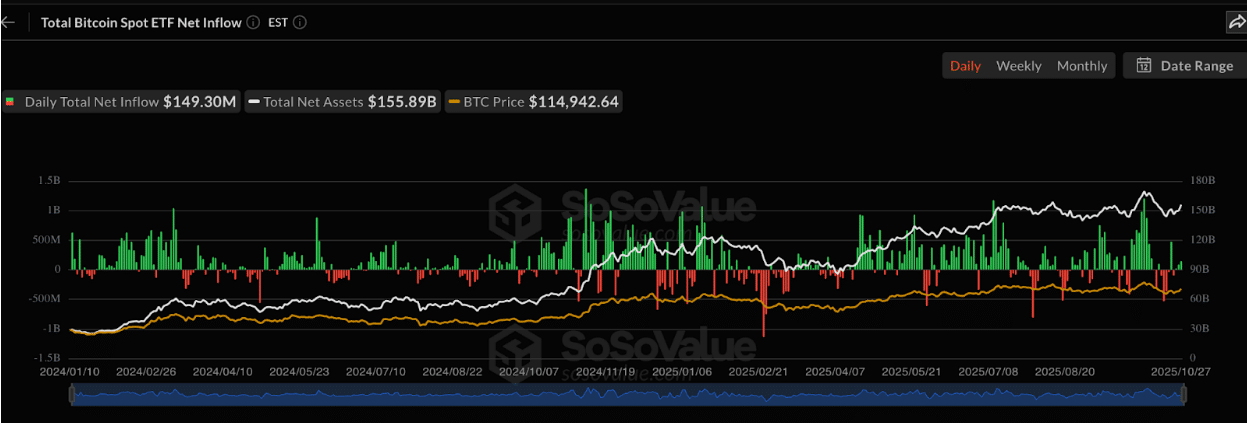

SoSoValue data shows that US Bitcoin Spot ETFs recorded a net inflow of $149 million, indicating that investors were consistently showing interest in Bitcoin regardless of price fluctuations.

Why did Bitcoin attract $931 million while Ethereum saw outflows?

According to CoinShares report, Investors added about $931 million to Bitcoin funds last week, even as ether products saw $169 million in outflows.

The split continued this week, pointing to higher demand for BTC than ETH.

Reuters reported that Canary Capital plans to launch the first Litecoin and Hedera spot ETF in the US on Tuesday. Bitwise is preparing a product focused on Solana, a move that is considered a test.

A separate report said the SEC is “prepared” to approve the Hedera and Litecoin ETFs, suggesting more altcoin products could soon enter the market.

In Washington, the White House has nominated Crypto policy lawyer Mike Selig will lead the Commodity Futures Trading Commission, signaling a continued focus on oversight of digital assets and market structure.

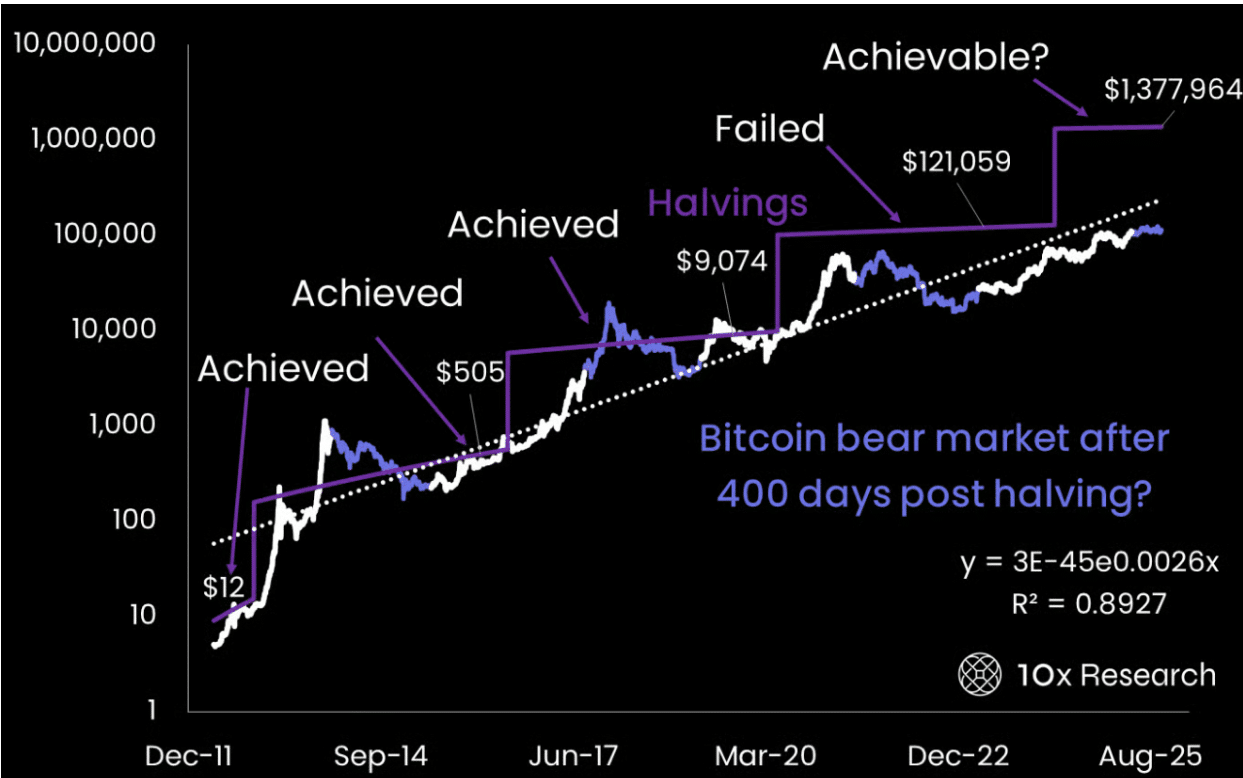

Meanwhile, 10x research warned that Bitcoin may now be too expensive for consistent retail purchase, which could weaken expectations of a longer bull cycle.

The firm said recent optimism about an extended market phase may not hold if habitual buyers begin to pull back.

Bitcoin is only 16 years old, so drawing “firm statistical conclusions” from such a limited history remains “highly questionable,” according to the report.

look chain reported BlackRock’s Ethereum spot ETF purchased 17,238 ETH worth approximately $70.69 million on October 27.

October 28 Update:

10 #Bitcoin ETFs

Net flow: +1,458 $BTC(+167.4 million dollars)#BlackRock entries 567 $BTC(+65.15 million dollars) and currently owns 805,807 $BTC($92.51 billion).

9 #Ethereum ETFs

Net flow: +27,066 $ETH(+111 million dollars)#BlackRock entries 17,238 $ETH($70.69 million) and currently owns 4,010,286… pic.twitter.com/MbCiAP2ml7

— Lookonchain (@lookonchain) October 28, 2025

It is also preceded by the US SEC’s approval of ETFs, which are spot ETFs, and these are indicative of the confidence BlackRock has in Ethereum as a long-term asset.

DISCOVER: The best new cryptocurrencies to invest in 2025

Bitcoin Price Prediction: Can Bitcoin Hold Above $113,500 to Maintain Bullish Momentum?

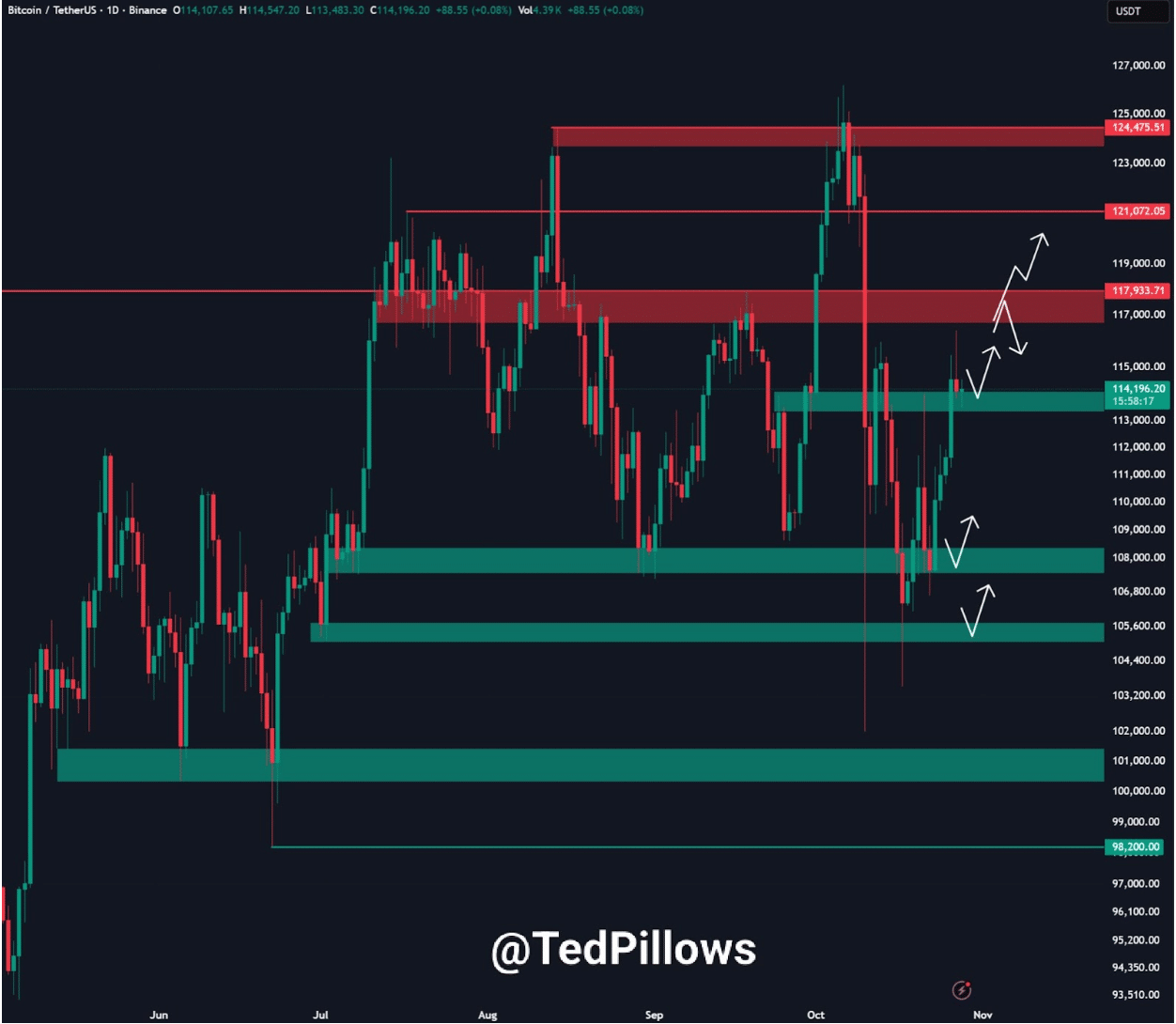

according to Ted’s analysis.Bitcoin is trading at a high of around $114,000 and has bounced off the support at $113,500. This level has served as a stable floor in the new tests.

The chart indicates that there is obvious buying interest between $112,000 and $113,500, and traders stepped in again to protect further losses.

Broadly speaking, sellers appear active between $116,500 and $118,000 and again between $121,000 and $125,000. If the price breaks above $117,500, the next target lies near $119,000, with room to extend towards the $121,000 area.

If the momentum cools, Bitcoin may fall back towards $111,000-$112,000. A break below that band could take the market towards $108,000, with another pocket of demand near $105,600.

For now, the price remains stuck in a wide range. Support lies below while supply caps bullish moves. The short-term outlook remains positive as long as BTC remains above $113,500.

Analyst Ali Martinez pointed to $111,160 as strong support based on cost data. It placed resistance near $117,630, where more sellers are likely to appear.

for bitcoins $BTC$111,160 acts as key support while $117,630 remains the resistance to break and continue bullish. pic.twitter.com/cRqVDrmdiZ

– Ali (@ali_charts) October 28, 2025

A move above that line could indicate a continuation. Otherwise, Bitcoin may remain in its current consolidation phase.

DISCOVER: 20+ upcoming cryptocurrencies that will explode in 2025

Ethereum Price Prediction: Selling Pressure Near Resistance Threatens Retracement to $3,800?

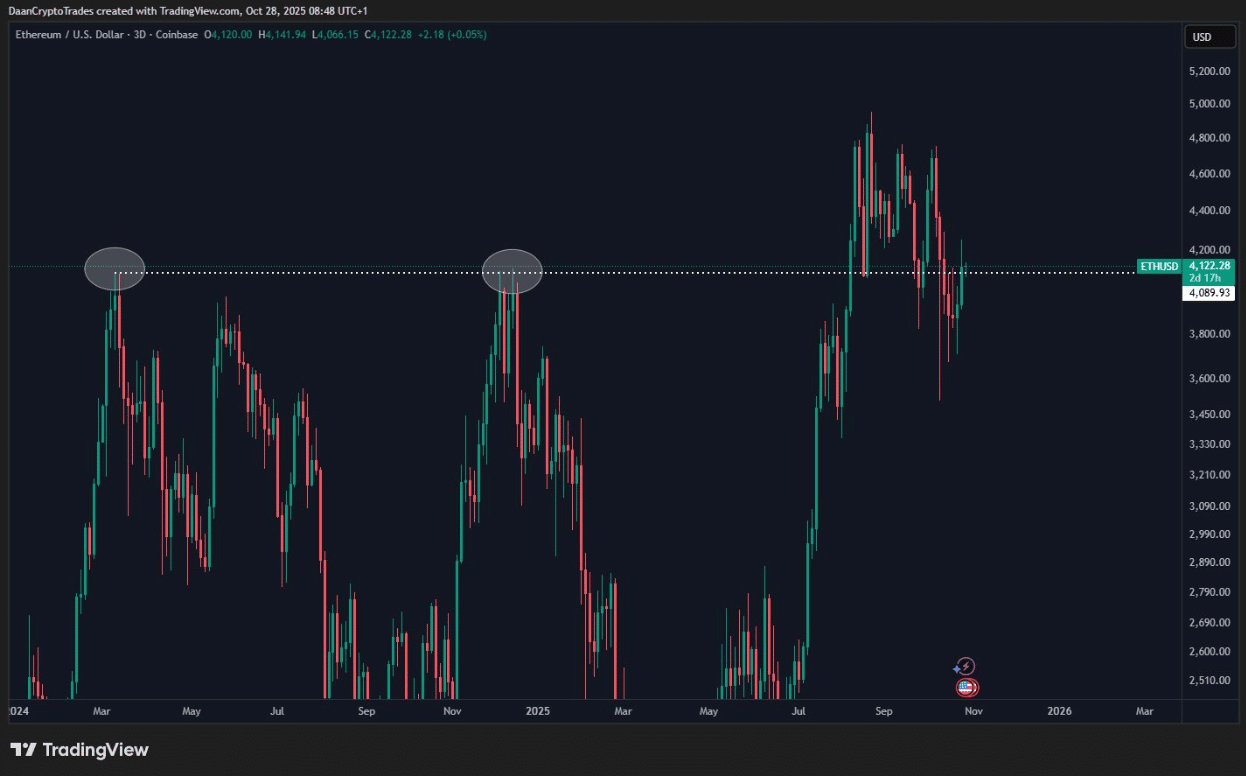

According Daan CryptoEthereum is once again entering a major resistance zone that previously marked cycle highs.

$ETH Great test here around their previous cycle highs.

To me, this is the level we need to break and hold if the bulls want to get back to the highs in due time.

Another rejection here would not be good for this broader temporal vision. https://t.co/xNJtY203aA pic.twitter.com/a4uoiZ6K1z

– Daan Crypto Trades (@DaanCrypto) October 28, 2025

The three-day chart indicates that ETH is trading below the first horizontal zone, which already rejected the price earlier in March 2024 and then at the end of 2024.

These two pullbacks have been sharp and demonstrate how strong this supply area has been.

The recent price movement indicates that a gradual uptrend will begin from the mid-2025 lows, and higher swing points will help recover the structure.

The rally has calmed down, but there is support for the trend.

The new candles indicate reluctance with several wicks touching resistance and indicating more selling.

The pattern looks like a multiple deck that forms under a flat roof. If ETH can break through this zone and hold, buyers can regain control and move towards $4,600 to $4,800.

But if the resistance holds again, the price could retreat towards $3,800, or even a broader demand zone near $3,500.

DISCOVER: More than 20 cryptocurrencies that will explode in 2025

Join the 99Bitcoins News Discord here for the latest market updates

The post Bitcoin and Ethereum Price Forecast: Consolidation Ahead? first appeared on 99Bitcoins.