Cryptocurrency

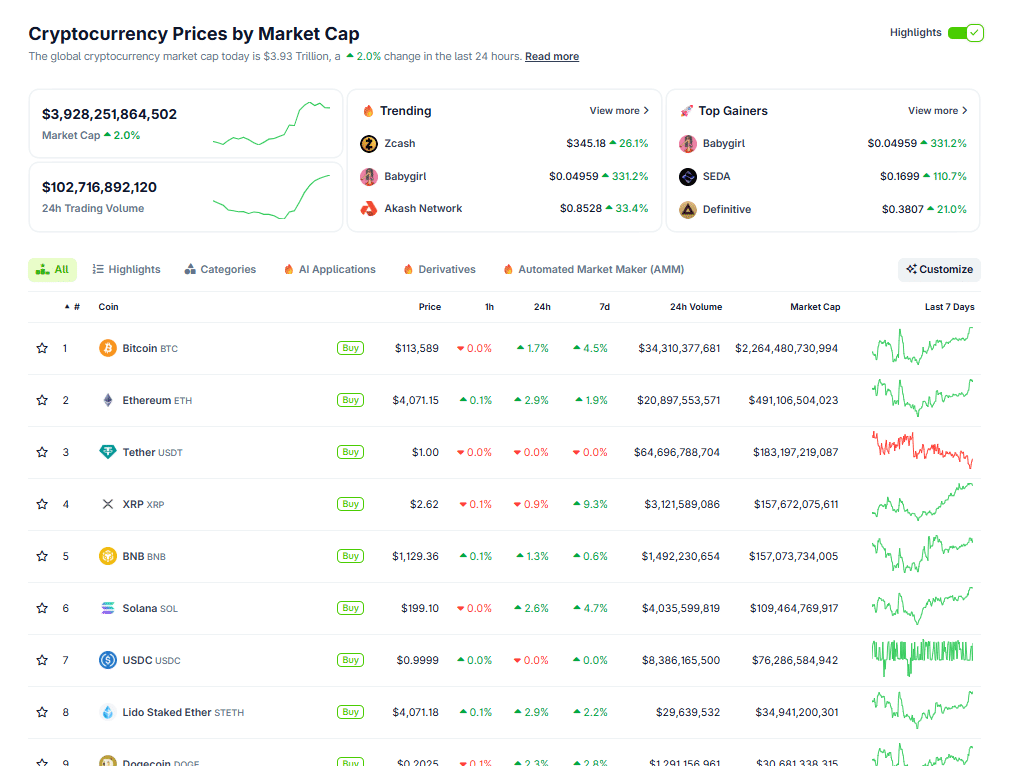

(Fountain – CoinGecko)

The token rose to $2.63 with a market capitalization of approximately $158 billion, surpassing BNB’s $156 billion as capital flows shifted dramatically in favor of XRP.

The move caps a +12.8% weekly rally, outperforming all other major digital assets and reigniting the debate over whether XRP is entering a long-awaited institutional cycle.

BNB, despite modest gains of +0.55% on the day and +4.35% on the week, appears to be losing momentum after a rally in October driven largely by regulatory relief and new US currency support, highlighted by former President Donald Trump’s pardon of Changpeng Zhao and Coinbase secondary market listings and Robinhood.

But the drivers behind XRP’s rise run deeper than simple market rotation.

XRP Institutional News Could Trigger Parabolic XRP Price Breakout

The notable catalyst is the emergence of Evernorth, a digital asset treasury (DAT) initiative that aims to accumulate and deploy XRP at scale.

Funded in part by Ripple co-founder Chris Larsen, who strategically liquidated a portion of his personal holdings to start the company, Evernorth is structured to tighten circulating supply rather than flooding it.

Backed by Japan’s SBI Group, the project is preparing a $1 billion-plus SPAC raise to establish an institutional-grade XRP reserve, with planned activities spanning liquidity provisioning, on-chain treasury management, and lending markets across the XRP Ledger.

This supply-constraining dynamic is emerging simultaneously as Ripple aggressively expands into enterprise payments, the growth of the RLUSD stablecoin approaches $1 billion in book assets, and Ripple Prime launches as a brokerage-style institutional access hub.

Meanwhile, the XRP ETF Race Is Accelerating. Grayscale, Bitwise, CoinShares, Franklin, WisdomTree, 21Shares and Canary filed coordinated and amended S-1 filings, a move analysts interpret as a direct response to the SEC’s comments, signaling regulatory alignment and removing a major bottleneck.

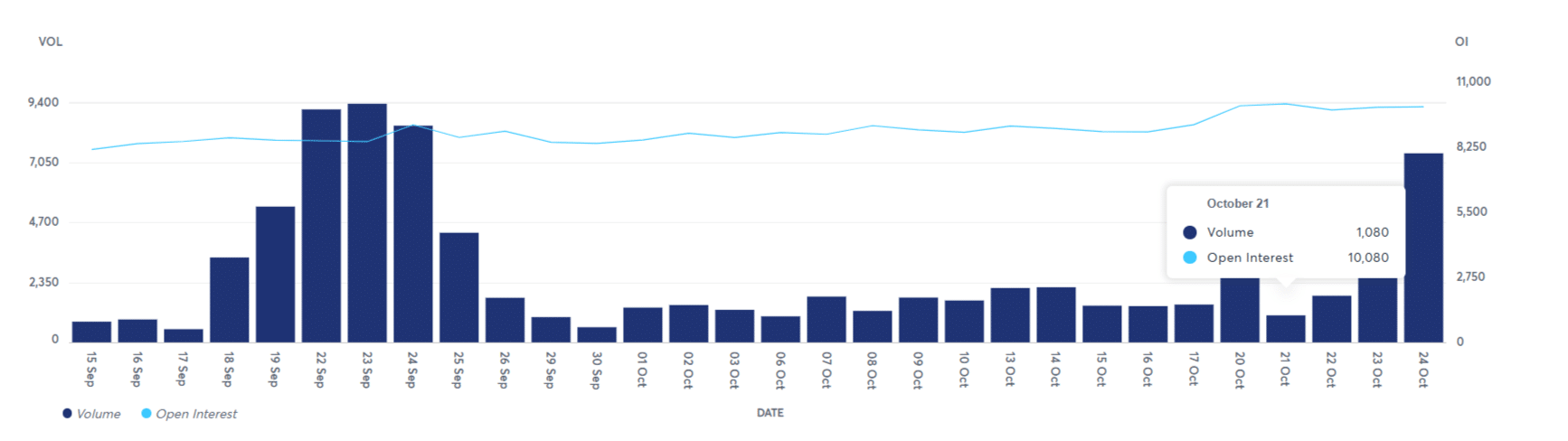

(Fountain – CME Group)

CME futures open interest has also increased, reaching $9.9 billion, while XRP spot ETFs have quietly accumulated over $100 million in assets under management within weeks of their launch.

Interestingly, sentiment among retail traders remains historically low, with small portfolios selling into the rally, creating a classic contrarian setup as institutional accumulation deepens.

EXPLORE: XRP Futures – Wave Trading Guide

XRP Price Analysis: Will Price Action Break Out to $2.9 After 20DMA Recovery?

As the price of XRP strengthens technically, XRP is currently trading at a market price of $2.61 (representing a 24-hour change of +0.74%) at the time of this publication.

This comes as bullish momentum to the upside saw XRP USD regain a foothold above the 20DMA support at $2.49 on Saturday, October 25, marking a pivotal moment when the price broke a resistance ceiling that had dominated the trend since October 7.

Now consolidating its position, box trading clearly shows a bullish trajectory for XRP next week (FOMC permitting), with immediate targets at $2.90 and $3.40.

(Fountain – TradingView, XRP USDT)

Meanwhile, the RSI indicator continues to bolster XRP’s price outlook, with a neutral reading at 51 highlighting that the move has not yet extended momentum too much, something that puts the +11% jump to $2.9 firmly in play.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

The post