Popular technician Charting Guy (@ChartingGuy) calls Shiba Inu “weak and choppy” and suggests that the token may not break out until late in the current crypto cycle. By sharing a Shiba Inu weekly chart, wrote on October 26, 2025: “SHIB has been weak and choppy throughout the cycle. In my opinion, I will not do anything until the end.”

How high can the price of the Shiba Inu go?

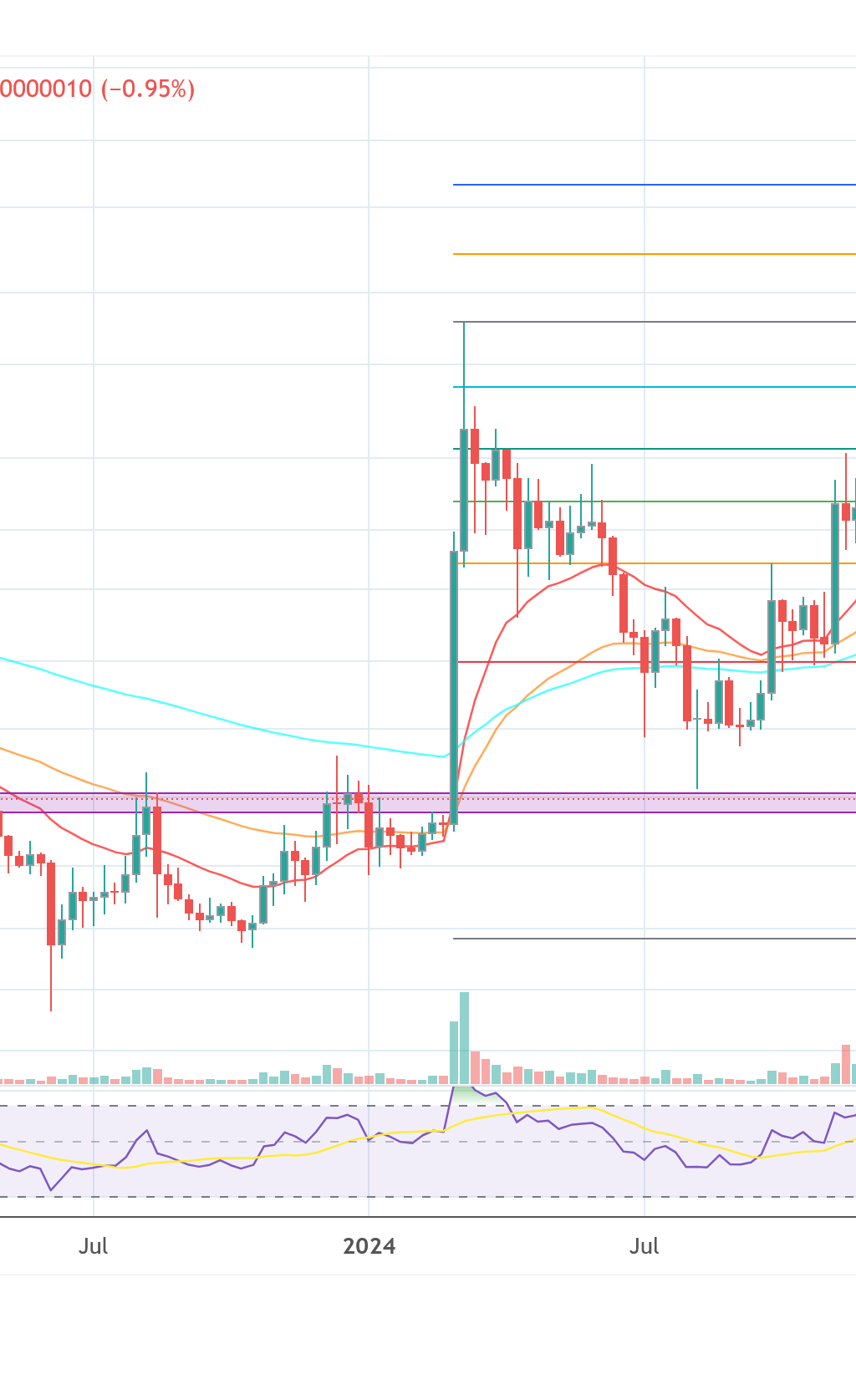

The TradingView chart below is a weekly study of SHIB/USD anchored to a Fibonacci ladder. The price marker on the right rail reads $0.000010205, placing SHIB slightly below the 0.236 retracement band noted at $0.000011043.

Above that, the chart shows successive overall levels at 0.382 near $0.000016434, 0.5 around $0.000022661, 0.618 near $0.000031247, and 0.786 at about $0.000049369. Red line 1 marks $0.000088410, with upper extension markers drawn at 1.272 ≈ $0.000185406, 1.414 ≈ $0.000272917, and a terminal 1.618 ≈ $0.000475605.

A stylized projection trace on the chart shows a near-vertical late-cycle advance that only materializes after a prolonged base and then stalls within the 1.0-1.272 group before breaking out of the 1.272 Fib extension and peaking below the 1.414 Fib extension at around $0.000022; the path visually reinforces the author’s claim that SHIB underperforms until the “end.”

Related reading

In a separate post on October 24, Charting Guy ranked the market structures between major and large-cap altcoins, explicitly placing SHIB in its “Bad Looking Charts” category and labeling Bitcoin, Ether, XRP, Solana, BNB, and Stellar as “Good Looking Charts.” Their list read, in part: “Hot charts: BTC, ETH, XRP, SOL, BNB, XLM… Hot charts: CRV, ALGO, SOLO, COREUM, NEAR, VET, COMP, DOT, IOTA, FIL, ATOM and many more.”

What to expect

The technical message is unmistakable: on a weekly timeframe, SHIB remains capped below early Fibonacci thresholds that many analysts treat as momentum gates. Staying below 0.236 typically indicates that price has yet to recover even the most shallow pullback from the previous cycle; Clearing it often opens up room to test the 0.382-0.5 midpoint zone where trends either accelerate or fail.

Related reading

On the Charting Guy map, structurally significant inflection areas accumulate closely from around $0.000016 to $0.000031, and the 0.618 level near $0.000031 is credited with the role of a trend confirmation threshold. The cycle top roadmap he drew concentrates risk and reward in the upper bracket, around $0.000088 to $0.000185, a range that Fibonacci practitioners often watch for exhaustion and distribution in late-stage moves. However, a rise to $0.00022 could still mean an incredible upside for SHIB of around 2,055.81%, an increase of about 20.56 times.

Contextually, your relative strength chart is just as important as the levels. By grouping SHIB with other “bad” structures while upgrading Bitcoin, Ether, That framework aligns with his succinct call that SHIB “will do nothing until the end,” implying a sequencing view rather than a categorical rejection.

At press time, SHIB was trading at $0.00001046.

Featured image created with DALL.E, chart from TradingView.com