Bitcoin Price News: After $1 Billion BTC Whale Sale, Will Bitcoin Stabilize and Ethereum Ecosystem Priorities Boost Confidence?

Bitcoin enters November after recording its first negative October in six years.

The drop has sparked debate among traders over whether the pullback indicates a deeper decline or a normal pause before the next move.

According CoinGeckoBitcoin price is down around -4.4% in the last day and is trading near $107,000.

That drop has helped lower the overall crypto market, with its total value falling 2.2% to $3.64 trillion.

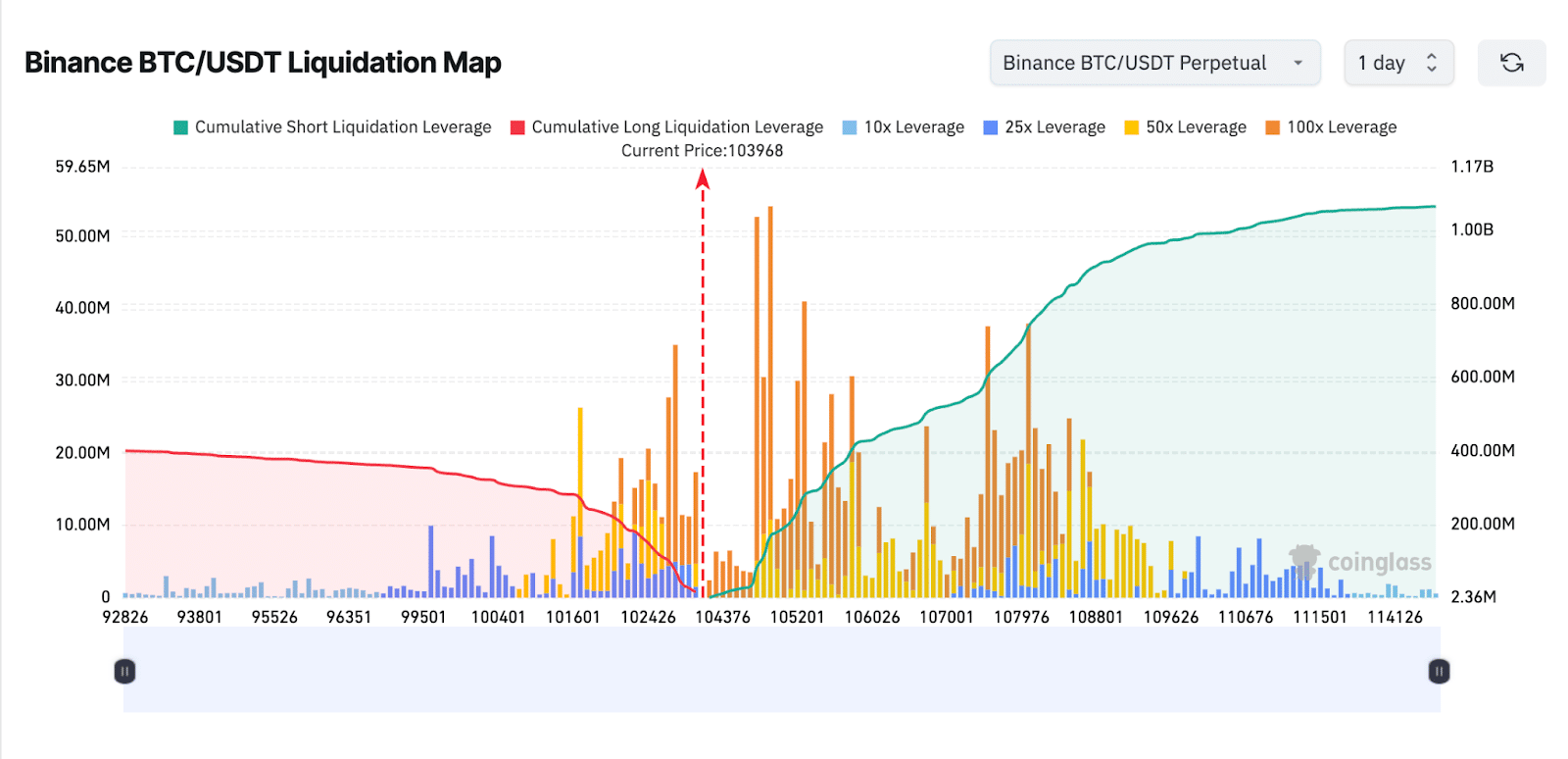

The pullback triggered more than $1.16 billion in long liquidations on Nov. 3, demonstrating how quickly leverage has been unwound in major venues.

The weakness came as global markets adjusted to changing political signals. Federal Reserve Chair Jerome Powell confirmed the end of quantitative tightening and said rate cuts were coming.

EXPLORE: The best Meme Coin ICOs to invest in in 2025

Bitcoin Price Prediction: Can Bitcoin Hold Its Key Weekly Support Near $103,000?

But subsequent comments dampened hopes of a December cut, adding uncertainty and weighing on risk assets.

A long-silent Bitcoin wallet also moved after almost 14 years. The address transferred 10,000 BTC, first purchased for around $1.54 each, said a crypto investor named Ted.

$BTC Whale bought 10,000 BTC at $1.54.

14 years ago.

I sold it today for $1,000,000,000.

pic.twitter.com/Sp7ysVeHM7

-Ted (@TedPillows) November 4, 2025

The holder is believed to have sold the entire amount today for approximately $1 billion, marking one of the largest profit-taking events linked to an early Bitcoin address.

On the charts, Bitcoin is now retesting a key support zone after pulling back towards a blue long-term moving average line on the weekly period.

The analyst noted that all major rallies since March 2023 have originated from this area, and previous touches have led to strong rebounds.

Every MASSIVE $BTC The rally since March 2023 started from this blue line.

We are here again…

If this week closes below $103,000, this cycle could be over. pic.twitter.com/wk8Dyw9acC

– AlΞx Wacy

(@wacy_time1) November 4, 2025

Bitcoin is trading near $103,000, sitting just above its key moving average band at the same level.

A weekly close below this zone could indicate that the rally is losing steam and open the door to a deeper pullback, possibly towards the $40,000 area.

If the trend line holds, the broader uptrend holds. In that case, analysts see room for a move towards $150,000 if buyers regain control.

DISCOVER: Next 1000X Cryptocurrency: 10+ Crypto Tokens That Can Reach 1000x by 2025

Ethereum Price Prediction: Could Ethereum Rebound From Its Long-Term Support Against Bitcoin?

Traders are watching how the market closes this week to get a clearer signal.

Meanwhile, the Ethereum Foundation has introduced a revised grant program designed to take a more proactive approach in supporting the ecosystem.

1/ ESP grant applications are now OPEN!

Our new grant program is structured through two channels:

Wish list

Requests for proposals (RFP)

Explore new opportunities and apply below!https://t.co/qg4gBL62ED

— EF Ecosystem Support Program (@EF_ESP) November 3, 2025

The group suspended new applications in August under its previous ESP framework, saying it needed time to reassess funding priorities.

Now you go down two paths: a “Wish List” and a “Request for Proposals.”

The wishlist points out broad areas where the Ethereum Foundation sees gaps worth addressing. The RFP route outlines specific problems and asks applicants to present practical solutions.

On the market side, the weekly Ethereum vs. Bitcoin chart shows the pair returning to a key demand zone near 0.032-0.035 BTC.

Analyst Michaël van de Poppe said the area offers a reasonable window for accumulation.

The pair has been falling since its late summer peak, giving a strong rebound of 145% since April. Price action is still forming lower highs, although the current pullback is approaching a previous support area.

$ETH You are currently moving in the ideal area for purchasing opportunities in the $BTC pair. pic.twitter.com/djvNEFAH6k

—Michaël van de Poppe (@CryptoMichNL) November 4, 2025

The 50-week moving average remains above the market, showing weakness. Trading volume is also declining, suggesting that selling pressure may be easing.

If this support holds, a short-term bounce is possible. But if buyers fail to defend the zone, the chart leaves room for a drop towards 0.026 BTC, with deeper levels around 0.022-0.019 BTC.

EXPLORE: The best new cryptocurrencies to invest in 2025

Join the 99Bitcoins News Discord here for the latest market updates

The Post After Billion Dollar BTC Whale Sale, Will Bitcoin Stabilize and Ethereum Ecosystem Priorities Increase Confidence? first appeared on 99Bitcoins.

(@wacy_time1)

(@wacy_time1)

Wish list

Wish list Requests for proposals (RFP)

Requests for proposals (RFP)