Unfortunately, cryptocurrency hacks happen all the time. Every time funds are stolen from a top-tier dApp, it becomes a huge moral impact for users and developers.

The Bybit hack garnered negative press, but it quickly subsided when the exchange assured the community that it would continue processing transactions regardless of the $1.3 billion loss. Today, however, is another sad day for Balancer and DeFi.

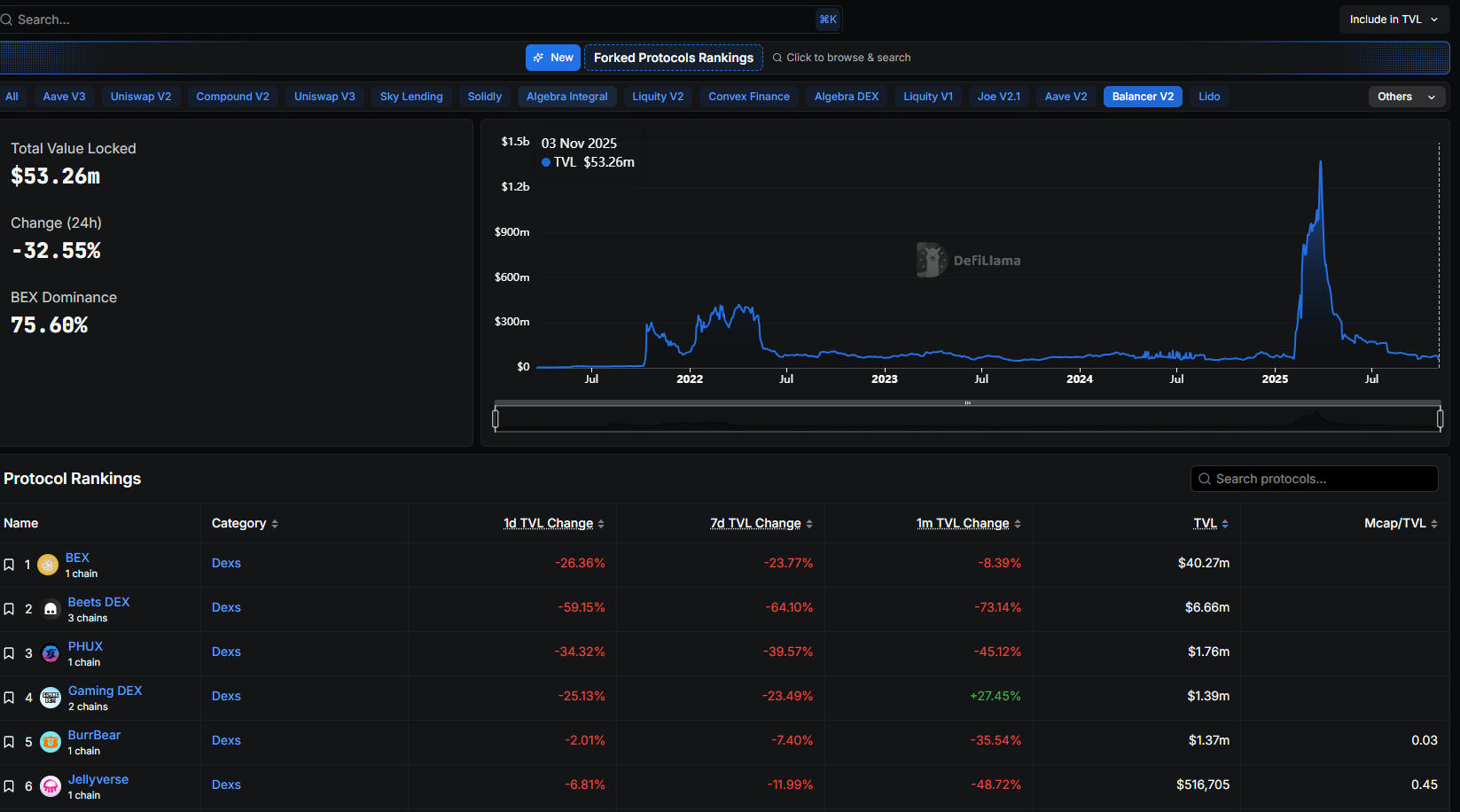

Earlier today, Balancer, one of the OG DeFi protocols, was hit (again), and the results are bad, not for the dapp but for the entire DeFi scene and layers 2 of Ethereum. Before today, Balancer administered more than $775 million, but the protocol is bleeding quickly.

We are aware of a possible exploit affecting Balancer v2 groups.

Our engineering and security teams are investigating with high priority.

We will share verified updates and next steps as soon as we have more information.

– Balancer (@Balancer) November 3, 2025

DISCOVER: The best new cryptocurrencies to invest in 2025

Balancer Hack: Over $120 Million and Growing Loss

To understand what’s going on, we first need to know what Balancer does.

For beginners, Balancer is a decentralized automated market making (AMM) protocol on Ethereum. From the dapp, other developers Ethereum Compatible Chains You can also create programmable liquidity solutions.

That you can fork the Balancer V2 code is a plus. If you are illiquid, you can supply assets and allow users to trade them while earning a return on any custom liquidity pool directly from Balancer.

But here’s the problem: Balancer only depended on a single central contract to manage all the vaults. The design was intended to increase gas efficiency, but this became the biggest flaw, now affecting not only Balancer but also all other implementations that depended on its code.

Here you will find everything you need to know about Balancer Hack:

1. The attack targeted Balancer’s V2 liquidity pools and vaults, exploiting a vulnerability in smart contract interactions. Preliminary analysis by on-chain researchers points to a maliciously implemented contract that… pic.twitter.com/udAM4hB0OD

-Adi (@AdiFlips) November 3, 2025

The hacker targeted the “manageUserBalance” function, effectively taking control of vault withdrawals and bypassing sender validation. So far, over $128 million has been mined from the vaults of multiple chains, including Berachain.

Update: @Rocker and its forks are under attack, with total losses across multiple chains reaching ~$128.64 million so far. https://t.co/67XGX5RcRR pic.twitter.com/FIwx20ALSz

– PeckShieldAlert (@PeckShieldAlert) November 3, 2025

The loss will likely increase because after the hacker drained the Balancer pools on Ethereum layer 1, the next targets were bridged equivalents on layers 2, i.e. wrapped tokens. What this is creating is a “domino effect” where a protocol using Balancer v2 code, especially if it is layer 2, has to pause operations until the flaw has been fixed.

Balancer v2 (+forks) exploited for over $100 million+TLDR:

Balancer v2 and its forks are affected:

• ETH → balancer → 70m

• Arbitrum → balancer → 6m

• Base → balancer → 4m

• @SonicLabs → beet → 3.4m

• OP → beet → 283k

• Polygon → balancer → 117kExploitative is… pic.twitter.com/yTTtrS5L3S

—Blub (@DeFi_Blub) November 3, 2025

DISCOVER: 9+ Best Memecoin to Buy in 2025

Berachain stops the chain

Out of an abundance of caution, Berachain, which is supposed to mirror the Ethereum mainnet and run 24/7, has been paused.

In a post on

Berachain validators have coordinated to intentionally halt the Berachain network while the core team performs an emergency fork to address Balancer V2-related exploits on BEX.

This stop has been made on purpose and the network will be operational shortly…

—Berachain Foundation

(@berachain) November 3, 2025

They are also aware that some may not be happy, but their main goal is to protect more than 12 million dollars of user funds.

Beefy, a performance optimizer, has also stopped all products linked to Balancer.

Balancer V2 Exploitation:

All Beefy Balancer V2 products are on pause. Our team is closely monitoring the situation.

We will cooperate to ensure that all losses are appropriately captured and that Beefy users participate fully in any recovery.

Our full support to the @Rocker equipment. pic.twitter.com/eC2JCkldRz

– Beefyfinance (@beefyfinance) November 3, 2025

They also promise to cooperate and ensure that all losses are properly accounted for.

The question now is: will other protocols, most of them DEXs, follow suit? On the Beets DEX, there is over $6.6 million in total value locked (TVL), for example, and this is just one of over 20 platforms that have forked the Balancer V2 code.

(Fountain: DeFiLlama)

DISCOVER: 10+ upcoming cryptocurrencies that will grow 100x by 2025

Balancer Hack Loses Over $128 Million and Berachain Stops

- Balancer is a DeFi OG

- The protocol managed more than 700 million dollars before the hack

- More than 128 million dollars withdrawn after exploitation of smart contract

- Berachain validators take caution and pause the chain

The post Balancer Hacked AGAIN, Over $128 Million Stolen: Will Ethereum Layers 2 Be Shut Down? first appeared on 99Bitcoins.

(@berachain)

(@berachain)