Key takeaways

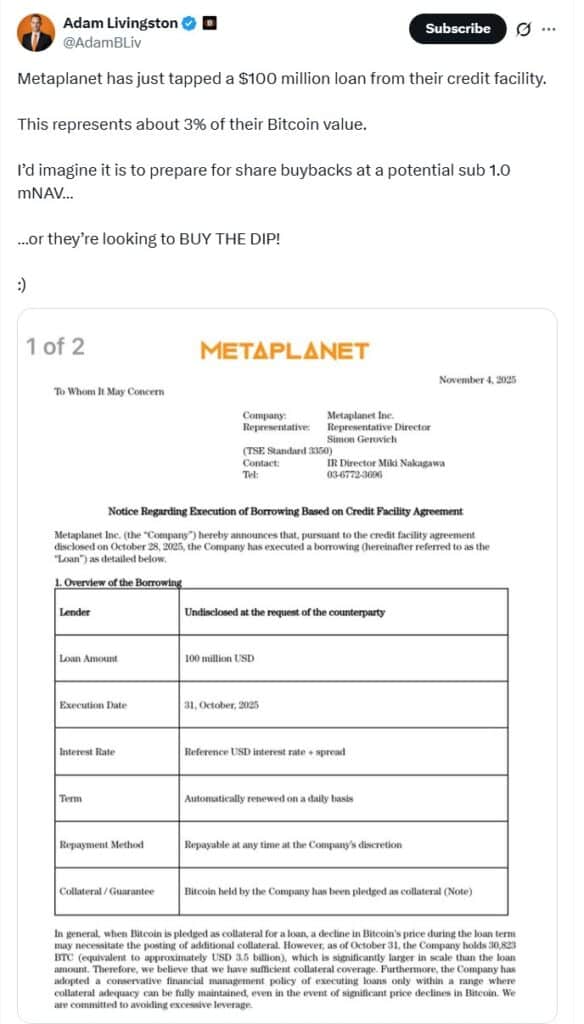

What drove the ICP short-term price bounce?

Likely, the accumulation of short liquidations in the $3.5 region over the past 24 hours helped attract higher prices to $3.67, along with high trading volumes.

Can this move fuel a long-term uptrend?

It is unlikely to usher in a recovery on its own – the ICP has been in a consistent downtrend since March and its weekly structure remains bearish.

Computer Internet [ICP] rose 6.5% in 24 hours. The gains were possibly due to an increase in demand in recent hours and were helped by a group of liquidations at the $3.55 level.

Classified as an “AI and Big Data” token by CoinMarketCapICP was trading in the supply zone since mid-October. The $3.75 region had served as resistance following the October 10 decline.

Meanwhile, in the long term the trend has been bearish.

The one-week chart showed a major downtrend since March. bitcoin [BTC] and large-cap altcoin rallies in recent April and June did little to break this downtrend, making the October sell-off simply a continuation of the trend.

What drove the price rebound and where is the ICP headed?

On November 1, ICP prices fell to the liquidity pool at the level of $3.33. Before they could fall further, prices rebounded to $3.5, where they fluctuated for almost a day.

During these hours, a lot of short liquidations accumulated at $3.55.

This built-up liquidity attracted the ICP higher on November 2 and fueled a rebound as high as $3.67. This was followed by another price drop.

Prices generally gravitate toward pools of liquidity before reversing or continuing to rise, depending on the prevailing trend. At press time, the next prominent magnetic zone is between $3.7 and $3.75.

However, the higher term bias was not entirely bullish.

Turn up the volume, turn down the momentum

Source: ICP/USDT on TradingView

The 1-day chart showed a bullish structure but also a notable supply zone at $3.78.

While there was high trading volume on November 1, the CMF remained below zero. So did the Awesome Oscillator, underscoring the ICP’s predominant bearish momentum.

Overall, bulls would be wise to exercise caution. A break above $3.8 and a retest of support would be a buying opportunity.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

![Internet computer mapping [ICP] 6.5% Increase: Traders, Watch THIS Next Internet computer mapping [ICP] 6.5% Increase: Traders, Watch THIS Next](https://ambcrypto.com/wp-content/uploads/2025/11/ICP-Featured-1000x600.webp)