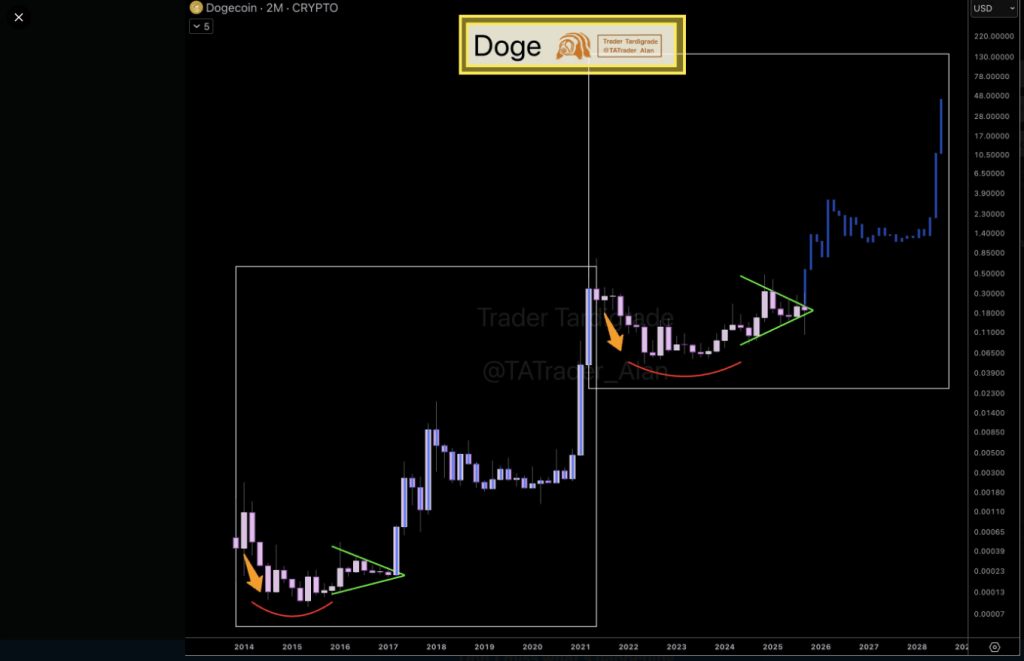

According to analyst Trader Tadrigrade, Dogecoin has been moving within a long-duration symmetrical triangle that echoes a setup seen in 2016-2017. The analyst reportedly used a two-month chart to compare the current price action to the buildup that preceded a breakout in March 2017.

At the time, DOGE rose from about $0.0003 to $0.0194 in January 2018, a 7% rally. Traders pointing to that episode say the current narrowing range looks familiar and could set the stage for a notable move.

The market moves this month

DOGE is trading at around $0.18 at the time of writing, after a 20% drop so far in October. That drop contrasts with recent Octobers: a 40% increase in October 2024, a 10% increase in October 2023 and a 100% jump in October 2022.

Prices have been compressing within the triangle since late 2024, and the tighter range has increased rumors among chart watchers that a breakout could be near.

$DOGE/2 months#Dogecoin is following its first cycle pic.twitter.com/FNFJo3C59I

— Tardigrade Trader (@TATrader_Alan) October 30, 2025

Goals after a leak

Analysts who favor the pattern are pointing to a first target near $3.90, which would represent a gain of around 2,000% from current levels if reached. Other much more daring projections are also shared.

A chart shown by the bulls extends towards $48 (an increase of 26,500%) which, if the circulating supply remained near 151 billion tokens, would imply a market value close to $7 trillion. That figure would dwarf most global asset classes and is widely considered unlikely.

Reports have also referenced a forecast of $18 last month, a level that would make many holders rich if it materialized, but remains a long shot.

Technical patterns versus broader forces

Pattern recognition can provide a clear rule for traders, but charts do not capture everything that drives price. Liquidity levels, investor interest, movements in Bitcoin, and changes in social attention all affect how far any rally can go.

For an increase of several thousand percent to occur, sustained purchases and greater public attention would be needed. Currently, the view is based primarily on a visual similarity between past and present setups rather than independent signals that a major rally is warranted.

Featured image from Pexels, chart from TradingView