Everyone said Ethereum’s price was set at $10,000 in this bull run, but now top analysts at a leading mining company say it won’t be until 2030.

Ethereum is now seen as a turnaround story, a setup that some analysts believe could benefit it.

Ethereum is currently going through a different phase: a slow recovery after a prolonged period of weak sentiment. Matt Hougan, chief investment officer at Bitwise, says this rebuilding period could provide investors with a useful entry point.

To understand this view, it is helpful to examine what has dragged the network down and what may be improving.

Is Ethereum still too expensive or are critics missing the bigger picture?

A crypto analyst suggests that Ethereum may need a strong rerating over the next year.

He expects the asset to “catch up with the M2 money supply” by the fourth quarter, which he believes supports a fair value of between $8,000 and $10,000 in early 2026.

$ETH will catch up with M2 supply in the fourth quarter.

Ethereum’s fair value is between $8,000 and $10,000 by the first quarter of 2026.

With institutional bidding and staking approval, I believe ETH will rebound strongly. pic.twitter.com/GWhdqetubr

-Ted (@TedPillows) October 13, 2025

It also highlights the growing interest of large investors. In his opinion, constant buying and the possibility of new betting approvals could help drive prices higher.

The message is simple: if demand increases and policy remains supportive, ETH may have room to run.

Earlier this year, even longtime supporters feared the ecosystem had lost steam as a series of setbacks piled up.

On-chain activity slowed and critics argued that the push to scale across Layer 2 networks had failed.

Once upon a time there was a cow called "$ETH" who was being squeezed dry by his “caretakers.” When the spectators said "hey that’s not good for $ETH"the ‘keepers’ became very angry with the passers-by, completely ignoring the irony that they were the ones who killed the cow for personal enrichment. pic.twitter.com/WBMtspGqqh

-Quinn Thompson (@qthomp) March 30, 2025

They said the approach weakened the token economy and moved value away from the main chain. Some even claimed that Ethereum was now overvalued and no longer attractive to investors.

Hougan, however, points out that Ethereum still has a fundamental advantage that many overlook: its central position within the stablecoin ecosystem.

“All payments will be made in stablecoins,” he said. Currently, most stablecoins operate on Ethereum.

USDT and USDC, which together account for more than two-thirds of the global stablecoin supply, are primarily issued on Ethereum.

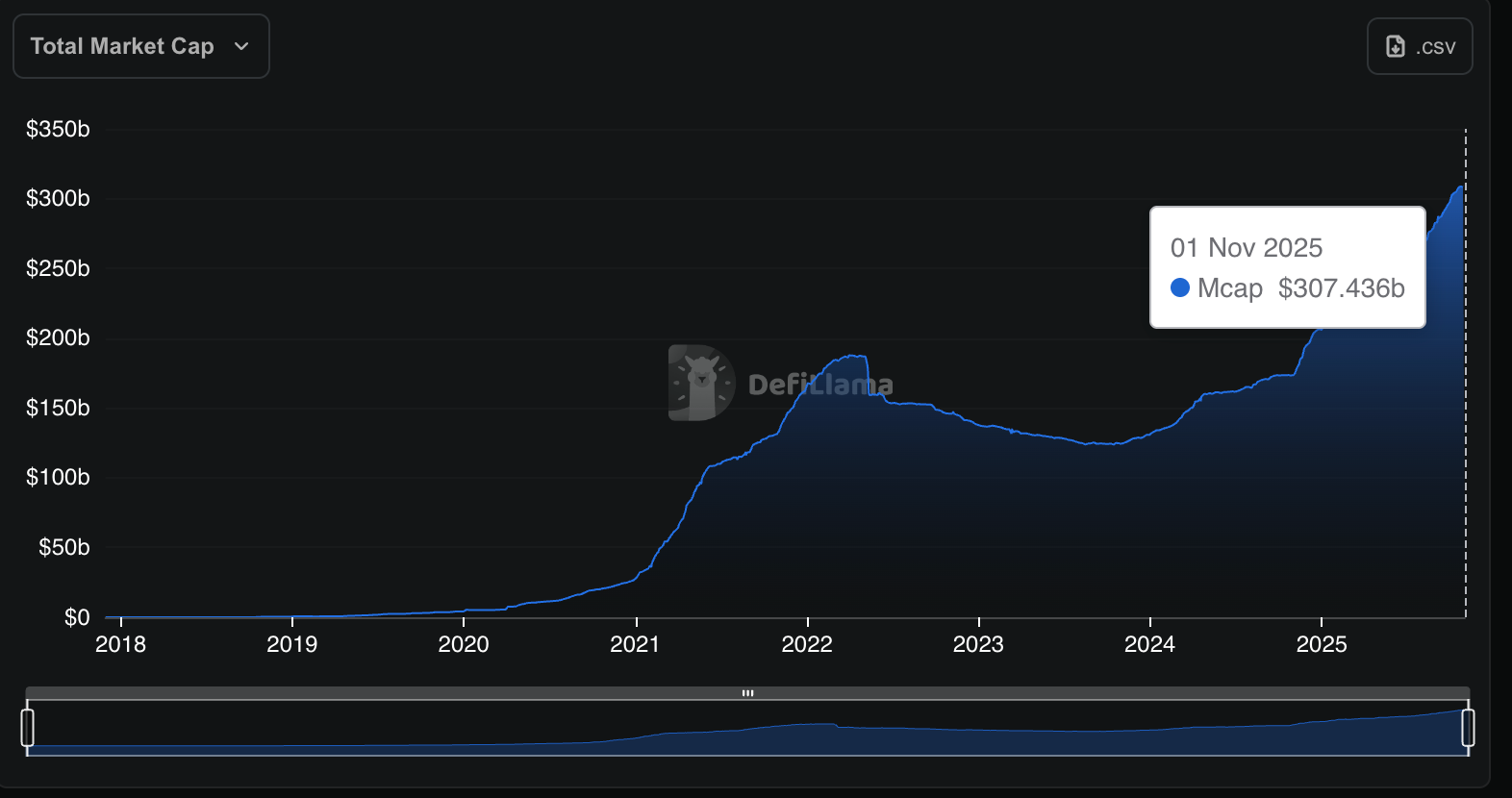

Data of DefiLlama indicates that more than 53% of the sector’s $307 billion market operates on Ethereum. Solana, on the other hand, has just over 4%.

As banks and payments companies adopt stablecoins for settlements, payments, and treasury work, Ethereum could remain the primary network supporting that activity.

Large institutions are already moving. JPMorgan, for example, has started accepting cryptocurrencies as collateral.

JPMorgan will allow its institutional clients to use bitcoin and ether as collateral for loans as cryptocurrencies continue to be sucked into Wall Street pipelines. Good scoop @emilyjnicolle and another example of Life moves pretty fast pic.twitter.com/ej68sOHm9J

– Eric Balchunas (@EricBalchunas) October 24, 2025

Vibe plans invest $1 billion in expanding the use of stablecoins in corporate treasuries. At the same time, BlackRock’s tokenized treasury finance has reached about 2.5 billion dollars.

Both moves direct more activity toward Ethereum, which earns fees when stablecoins are transferred across the network.

Tom Lee, a well-known strategist who helps run one of the largest treasury firms focused on Ethereum, called stablecoins the “ChatGPT of cryptocurrencies” in a June 30 report. interview on CNBC, citing its rapid adoption.

Ethereum Price Prediction: Will ETH Regain Market Share If 12-13% Zone Holds?

According to Mister Crypto, Ethereum’s market share may be close to a rebound.

The chart shows ETH dominance sliding towards an ascending trend line that has held since April 2025.

Every time the price touched this line in the past, marked by green arrows, the market experienced a new bullish movement.

The latest candle sits just above that trend line, suggesting that buyers are still protecting the 12-13% area.

That support has acted as a floor before and traders are watching to see if it does the same again.

The price action is still pointing to an uptrend, even though things have cooled down.

Ethereum’s dominance retreated from over 16% in late summer, but continues to form higher lows, suggesting the overall structure holds.

The stochastic oscillator has fallen into oversold territory for the first time since early 2025. That setup looks similar to moments before strong rebounds.

If this support level holds, Ethereum may begin to gain market share again as traders shift towards top altcoins. But if the trend line breaks, it would be a sign that strength is fading and could further delay any recovery.

DISCOVER: The 12+ Most Popular Cryptocurrency Presales to Buy Right Now

The article Ethereum price at $10,000? Analysts say this cycle first appeared on 99Bitcoins.