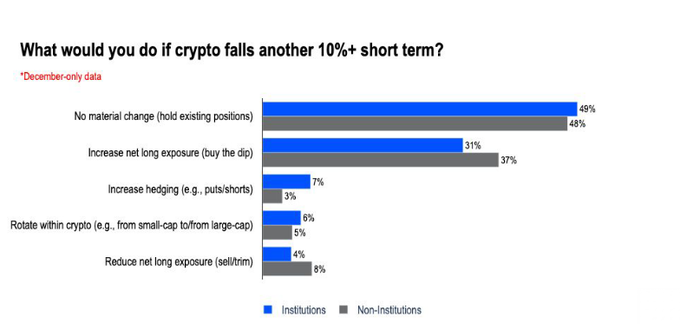

A recent Coinbase survey shows that institutional investors remain very confident in cryptocurrencies. Even if crypto market crashes At 10%, 80% of participants would maintain or increase their cryptocurrency positions, underscoring strong conviction and long-term growth potential despite short-term volatility.

This bullish sentiment is backed by historical trends: More than 60% of institutions surveyed have maintained or increased their cryptocurrency holdings since Bitcoin’s $126,080 peak in October, indicating that major investors are capitalizing on market declines to expand their exposure.

In particular, the findings indicate that institutional participation in cryptocurrencies is moving from speculation to strategic allocation.

Unlike retail investors driven by short-term market swings, institutions are incorporating Bitcoin and other major cryptocurrencies into diversified portfolios, seeing them as potential inflation hedges and complements to traditional assets.

Therefore, rising institutional demand is stabilizing crypto markets by increasing liquidity and moderating volatility, reducing panic-driven sell-offs.

Measures like Michael Saylor’s recent $264 million BTC purchase highlight growing confidence, indicating that digital assets are gaining legitimacy alongside stocks, bonds and commodities in strategic portfolios.

Why does this matter? Well, institutional demand for cryptocurrencies is driving innovation in financial products, from regulated funds to cryptocurrency-linked ETFs, expanding access to a broader range of investors. This creates a reinforcing cycle: greater institutional involvement drives stability, which drives new product development and broader adoption.

Coinbase survey shows a fundamental shift in the crypto landscape. Despite market volatility, the long-term outlook for Bitcoin and digital assets remains very positive.